Updated: 08:40

SGX-NF: 11330 (-10; -0.09%)

Expected BNF opening: 27825 (-30;-0.10%)

SPX-500: 2805 (+2; +0.07%)

Fut-I (Key Technical Levels)

Support for NF:

11305/11275*-11225/11175-11145/11100-11065/11015

Resistance to NF:

11365/11385*-11415/11500-11535/11605-11680/11725

Support for BNF:

27850/27750-27640*/27500-27400/27300-27150/27000

Resistance to BNF:

27950*/28150-28300/28450-28525/28685-28800/29100

Support for SPX-500:

2805/2790*-2760/2740-2710/2695-2665/2640

Resistance to SPX-500:

2825/2860*-2880/2905-2925/2960-3010/3035

Technical

View (Nifty, Bank Nifty, SPX-500):

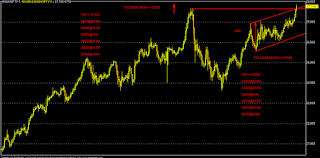

Technically, Nifty Fut-I (NF) has to sustain over 11385 for a

further rally to 11415/11500-11535/11605-11680/11725 in the near term (under

bullish case scenario).

On the flip side, sustaining below 11365 NF may fall to 11305/11275-11225/11175-11145/11100

in the near term (under bear case scenario).

Technically, Bank Nifty Fut-I (BNF) has to sustain over 27950

for a further rally to 28150/28300-28450/28525-28685/28800 in the near term (under bullish case

scenario).

On the flip side, sustaining below 27900-27850 BNF may fall to 27750/27640-27500/27400-27300/27150

in the near term (under bear case scenario).

Technically, SPX-500 has to

sustain over 2825 for a further rally to 2860/2880-2905/2925-2960/3010 in the near term (under bullish case

scenario).

On the flip side, sustaining below

2815-2805 SPX-500 may fall to 2790/2760-2740/2710-2695/2665 in the near term (under bear case

scenario).

Valuation metrics:

Nifty-50: 11320; Q4FY18 EPS: 402; Q4FY18 PE: 28.16;

Avg FWD PE: 20; Proj FY-19 EPS: 425; Proj Fair Value: 8500

Bank Nifty: 27843; Q4FY18 EPS: 519; Q4FY18 PE: 53.65;

Avg FWD PE: 20; Proj FY-19 EPS: 961; Proj Fair Value: 19220

SPX-500: 2803; TTM Q4-2017 EPS: 111; TTM PE: 25.25

GLOBAL MARKETS UPDATE: iforex.in/news

FOLLOW ME: twitter.com/ASISIIFL

NIFTY-SGX-NF

BANK NIFTY-BNF

USDJPY

GBPUSD