The Indian market (Nifty Fut/India-50) is currently trading around 10930.00

early Tuesday, slumped by almost -0.35% on subdued global cues amid renewed US-China

cold/trade war tensions. As per reports, the US will proceed with extradition

request for the arrested Huawei executive in Canada. The arrested Huawei CFO

Meng is being detained on charges related to Huawei "allegedly stealing

trade secrets from U.S. business partners, including the technology for a

robotic device called "Tappy" that T-Mobile US used to test smartphones”.

Nifty jumped Monday on hopes of a rate cut, mixed global cues

and led by exporters on higher USD; RIL and techs helped:

The Indian market (Nifty Fut/India-50) closed around 10964.50 Monday, jumped

by almost +0.34% on mixed global cues after a stable and expected set of

economic data from China (GDP, Industrial productions and retail sales) coupled

with growing optimism about the US-China trade truce progress and RBI rate

cuts.

But Early

Monday, the “risk-on” trade was under some stress on a report that

despite growing optimism story about the US-China trade truce progress, on the

vital issue of IP protection, there is absolutely no progress as reported by

the US Treasury to the US Congress. China

officials have denied such IP theft

allegation and asked the US for proof.

Subsequently, the US future SPX-500 dropped over

-0.30%, while Europe also slumped around -0.40%. But China and Hong Kong

recovered from an earlier slump on a stable

set of economic data and hopes of China stimulus as ultimately China’s 2018 GDP

came at +6.60%, the lowest in last 28-years.

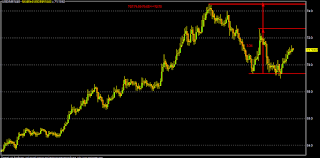

Technical View (Nifty, Bank Nifty, USDINR):

Technically, whatever may be the

narrative Nifty Fut-I (NF) has to sustain over 11075 for a further

rally to 11130*/11205-11245/11315 and 11405/11495-11620/11785-11825 in the near

term (under bullish case scenario).

On the flip side, sustaining

below 11050-11010, NF may fall to 10900*/10840-10800/10750 and

10660/10575-10500/10350 in the near term (under bear case scenario).

Technically, Bank Nifty Fut-I

(BNF) has to sustain over 27800 for a further rally to 27880*/27945-28175/28410

and 28465/28550-28800/29100 in the near term (under bullish case scenario).

On the flip side, sustaining

below 27750-27650, BNF may again fall to 27400*/27200-27050/26700 and 26400/26250-26000/25700

in the near term (under bear case scenario).

Technically, USDINR (spot) has

to sustain over 70.80 for a further rally to 71.50/71.75*-72.00/72.75 and

73.05/74.00-74.50/76.05 in the near term (under bullish case scenario).

On the flip side, sustaining below

70.45, USDINR may fall to 70.10/69.75*-69.10/68.45 and 67.85/66.95-66.40/65.70 in

the near term (under bear case scenario).

For more----https://iforex.in/news

FOLLOW ME: http://twitter.com/ASISIIFL

NSEI-NIFTY FUT

NSEBANK-BANKNIFTY FUT

USDINR

CL-WTI CRUDE OIL FUT

No comments:

Post a Comment