Jubilant Foods (JF) has given immense rally on the back of Same Stores Sales Growth (SSSG) and expansion plan with Dunkin Donuts. Its also a reflection of India's prospective GDP growth story and higher disposable income, specially for the urban youths. But it appears that it ran too much within a short period of time (obviously its a high beta scrip) and this may be far ahead of its fundamentals (present P/E is around 91 against industry average 49). So, some retracements could happen.

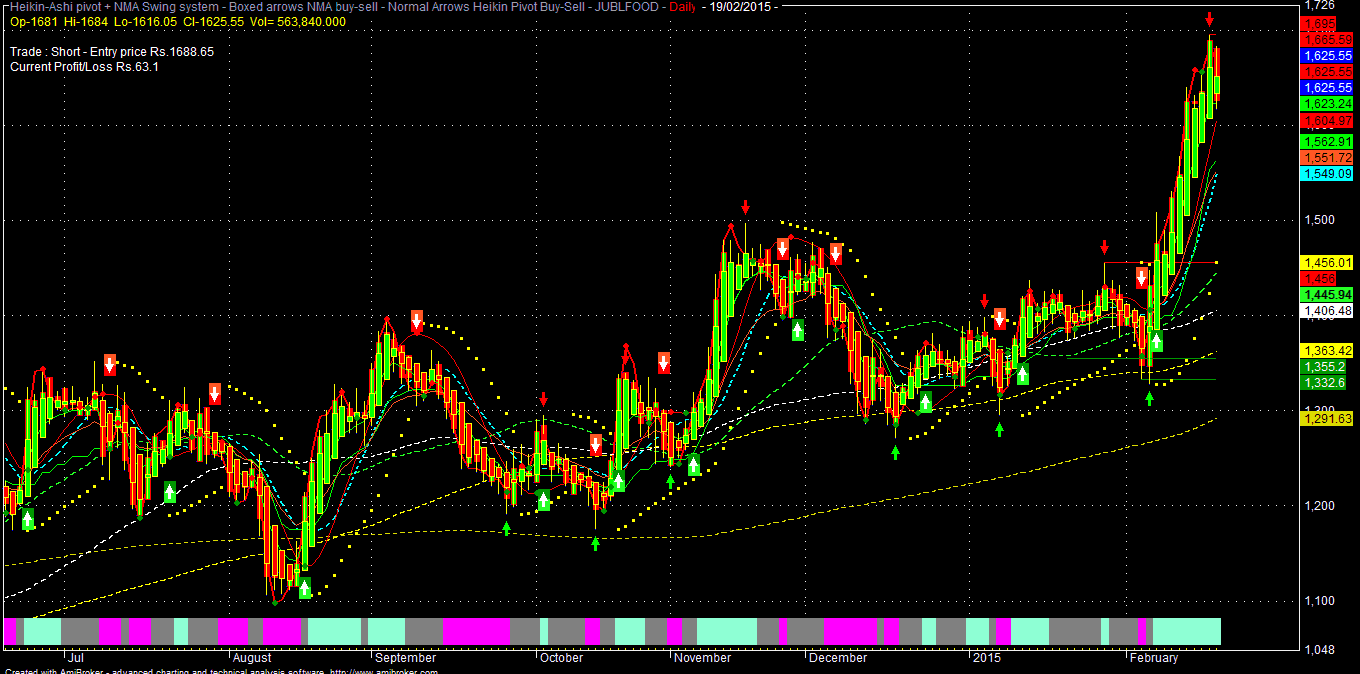

Looking at the chart, technically, JF (CMP: 1625) has to sustain above 1700-1720 zone for 1875 in the medium term (may be after dream budget ??). Its immediate support is around 1600 & sustain below that it could retrace up to 1542-1494 and 1447-1380 area, where it could attract some buying support.

No comments:

Post a Comment