Market Wrap: 24/10/2017 (17:00)

NSE-NF (Oct):10220 (+30; +0.30%)

(TTM PE: 26.45; Abv 2-SD of 25; TTM Q1FY18 EPS: 386;

NS: 10208; Avg PE: 20; Proj FY-18 EPS: 418; Proj Fair Value: 8360)

NSE-BNF (Sep):24236 (+113; +0.47%)

(TTM PE: 27.49; Abv 2-SD of 25; TTM Q1FY18 EPS: 881;

BNS: 24222; Avg PE: 20; Proj FY-18 EPS: 961; Proj Fair Value: 19220)

For 25/10/2017:

Key support for NF: 10180-10150/10100

Key resistance for NF: 10275-10325/10380

Key support for BNF: 24000-23850

Key resistance for BNF: 24400-24600

Hints for positional trading:

Technicals indicate that, NF has to sustain over 10275 area for

further rally towards 10325- 10380 & 10455-10495 area in the short term

(under bullish case scenario).

On the flip side, sustaining below 10255 area, NF may fall

towards 10180-10150/10100 & 10040-9965 area in the short term (under bear

case scenario).

Similarly, BNF has to sustain over 24400 area for further rally

towards 24600-24900 & 25100-25250 area in the near term (under bullish case

scenario).

On the flip side, sustaining below 24350 area, BNF may fall

towards 24225-24000 & 23850 -23600 area in the near term (under bear case

scenario).

Indian market (Nifty Fut/India-50)

today closed around 10220, edged up by almost 30 points (+0.30%) after making

an opening session high of 10244 and mid-day low of 10187. Indian market today

opened around 10203, almost flat tracking muted global cues amid mixed

US/global corporate earnings and ongoing suspense about next Fed leadership and

basically consolidated ahead of domestic earnings deluge.

But, buzz PSBS recap & some fiscal stimulus by the Govt to

dig out the Indian economy from its deepest slumps in the last three years may

have boosted the market sentiment towards the closing session and it closed the

day with modest gains; FMO was supposed to hold a presser for details of PSBS

recap & other fiscal stimulus measures after the market hours. Thus PSBS

(public sector banks) were upbeat on hopes of early recapitalization.

But some concern for fiscal discipline may remains and thus

overall market sentiment was cautious coupled with pessimism over Q2FY18

earnings trajectory. So far Q2FY18 earnings are mixed & stable, although it

may be not so much upbeat to justify the stretched valuations. Thus market may

be cautious amid slowing GDP growth and subdued guidance, while expectations

& valuations are very high.

Infy report card after market hours may be termed as mixed with

muted guidance. HDFC Bank’s result & NPA situation may be also termed as

subdued as valuations are already stretched.

Today Nifty was supported

by SBI, ZEEL, ICICI Bank, Asian Paints, VEDL, IOC, HUL, ONGC, UPL

& HPCL by around 37 points cumulatively, while it was dragged by Infy, Tata Motors, RIL, Indusind Bank, Yes Bank, HCL

Tech, M&M, Sun Pharma, TCS & Tech-M by around 25 points altogether.

Overall, Indian market was today helped by PSBS (earlier recap

hopes), telecoms (renewed optimism after R-Jio tariff hikes and permission by

the Govt to share telecom infra), utilities, power, property developers/real

estate (affordable housing push & plan of GST inclusion and big spending in

roads) FMCG, while it was dragged by healthcare, consumer durables, techs/IT

(concerns for muted report card).

After market hours today, FMO has unveiled plan for an “unprecedented infusion of Rs.2.11

tln in PSBS to boost lending” and road infra building for around 84000 km in

the next five years by around Rs.7 tln.

So far at a glance, this is a Rs.10 tln fiscal stimulus package

and Govt will support Rs.0.76 tln for the Bank Recap directly by budgetary

provision, while the rest of Rs.1.35 tln will come from issuing some types of

recap bonds (not GSEC) to the banks, which may be converted into equity shares

in future and may be equity dilutive also.

Govt is expecting that such issuance of recap bonds will not

affect the fiscal deficit in any manner (?). But Indian bond market may also

react to this PSBS recap bond issuance proposal, which is simply a financial

engineering as Govt is unable to recapitalize the banks by direct fund

infusion. All eyes may be now on RBI for their comments regarding this PSBS

recap bonds financial engineering. For road building in PPP mode, Govt is

expecting significant private participation/funding.

Overall, market may be keen to know the fine prints of today’s

Rs.10 tln fiscal stimulus package announcement by the Govt and mode of funding

& subsequent effect on the whole fiscal discipline narrative. Govt may take

a final call for fiscal deficit target and any breach thereof in Dec’17. Govt

will also announce various other reforms for PSBS in the next few months.

Clearly, Govt has an eye on the forthcoming election in Gujarat,

where it’s facing tough political questions over GST & DeMo blues and

subsequent economic slowdown and unemployment. State like Gujarat is heavily

affected due to unfavorable GST on man-made textile yarn, snacks and MSMES are

worst affected all over the country.

As par Indian FM: Government will appropriately respond to economic challenges; India

ready to deal with challenges as they develop; Aim is to retain India's high

growth economy status; Effort is to sustain high economic growth rate; Structural

reforms bring long-term benefit; India's macroeconomic fundamentals remain

sound; Govt has chalked out roadmap to boost economy.

As par Economic affairs

secretary: inflation will not cross 4% this year;

inflation consistently down in last 3 years; current account deficit very low; slower

growth in GDP has bottomed out; GDP

growth will soon be over 8%.

It seems that Govt has decided to push growth by big capex, even

if breaches fiscal deficit by some points. Govt is also signaling PSBS/Banks to

resume lending in a big way to push private capex, but the problem may be that there is significant lack of eligible &

quality corporate borrowers as of now amid stressed corporate B/S;

liquidity was not an issue for big bang corporate lending even before DeMo.

Govt is also expecting a GDP growth of over 8% (?) “soon”; i.e.

in FY-19. An economy, which is poised to grow by over 8%, should not expect

more central bank monetary stimulus/rate cuts and thus RBI’s rate cut hopes

further diminished today!!

Global Cues Are Muted Amid Mixed Earnings & Ongoing Fed Leadership Suspense:

Asian Stocks Edged Higher On Muted Global Cues Amid Fed Chair & China Policy Uncertainty

European Stocks Inched Up On Higher EUR Ahead Of ECB & Mixed Earnings

USD Surged To Almost 114 On Upbeat US PMI & Corporate Earnings/Stocks

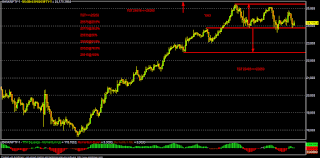

SGX-NF

BNF

10YUSTSY BONDS

No comments:

Post a Comment