Market Wrap: 11/10/2017 (17:00)

NSE-NF (Oct):10117 (+124; +1.25%)

(TTM PE: 26.22; Abv 2-SD of 25; TTM Q1FY18 EPS: 385;

NS: 10096; Avg PE: 20; Proj FY-18 EPS: 418; Proj Fair Value: 8360)

NSE-BNF (Sep):24382 (+271; +1.12%)

(TTM PE: 27.75; Abv 2-SD of 25; TTM Q1FY18 EPS:

878; BNS: 24361; Avg PE: 20; Proj FY-18 EPS: 961; Proj Fair Value: 19220)

For 13/10/2017:

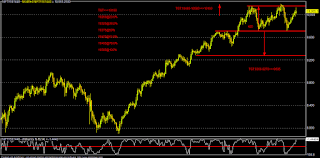

Key support for NF: 10085-10035

Key resistance for NF: 10165-10205

Key support for BNF: 24300-24000

Key resistance for BNF: 24600-24800

Technicals indicate that, NF has to sustain over 10165 area for

further rally towards 10205-10275 & 10325-10380 area in the short term

(under bullish case scenario).

On the flip side, sustaining below 10145 area, NF may fall towards

10085-10035 & 9990-9950 area in the short term (under bear case scenario).

Similarly, BNF has to sustain over 24600 area for further rally

towards 24800-25050 & 25250-25500 area in the near term (under bullish case

scenario).

On the flip side, sustaining below 24550 area, BNF may fall

towards 24300-24200 & 24000-23750 area in the near term (under bear case

scenario).

Indian market (Nifty Fut/India-50)

today closed around 10117, at day high, surged by almost 124 points (+1.25%),

boosted by a late hours rally; it made an opening session low of 9995.

Indian market today opened around 10118, gap-up by almost 36

points tracking positive global/US/HK cues amid dovish FOMC minutes & Q2

earnings optimism and consolidated till EU market opening. But it caught a bid

after some positive EU market momentum as EUR goes down on Catalan tensions.

Also, in line with estimates results from Indusind Bank coupled

with hopes for a block buster result from RIL (to be released tomorrow after

market hours) may have ignited the sudden short covering and some value buying

today.

Indian market sentiment was further boosted today on upbeat direct

tax collection figure and a “Diwali Gift” by the Govt for around 8 lakh

teachers & educational staffs for the 7-CPC salary increments along with arrears.

Basically, Indian market today tried to catch up the global

market, most of which are at multiyear milestone highs amid earnings & growth

(PMI) optimism despite ongoing geo-political tensions involving NK.

Today Nifty was supported by RIL (earnings optimism), HDFC Bank,

Bharti Infratel (tower deal buzz), TCS (hopes for good earnings), VEDL,

Hindalco, HUL, Bajaj Finance, Tata Motors & Axis Bank cumulatively by

around 78 points.

Nifty was today dragged by IOC (drops plan to merge with Chennai

Petro), Infy, Bharti Airtel, Ultratech Cement & SBI by around 7 points

altogether.

Overall, Indian market was today helped by private banks, FMCG,

metals, healthcare, automakers while it was dragged by PSBS on huge NPA &

recap concerns

Meanwhile, India’s CPI for Sep came as 3.28% vs estimate of 3.60%; prior: 3.36%; core

inflation came as 4.6% vs 4.5% prior. Rate cut hopes by RBI may be diminished

more on sticky nature of core CPI. Also, for an economy, inflation & growth

(GDP) should run proportionally and the “subdued” nature of headline CPI may be

also an indication that GDP may be still muted.

IIP for Aug came as upbeat at 4.3% vs estimate of 2.4%; prior:

1.2%; almost all the sectors including Mfg, Mining, Electricity and Consumer

durables & non-durables has registered solid growth in Aug after Pre-GST

disruptions and may calm the nerves of the policy makers haunting for suitable

fiscal stimulus to reboot the economy from its deepest slump in the last three

years.

Globally, almost all the

major Asia-Pacific stock markets

except China are now trading in deep to moderate green following positive

Global/US cues ahead of earnings deluge & macro data.

Overnight US market edged up & closed in another record milestone on lower USD after a dovish FOMC minutes

(Sep), published yesterday. Although, it seems that Fed is poised to hike in

Dec’17, the rate hikes projections for 2018 may be in doubt on concern of

puzzling subdued US inflation as several Fed members felt that the persistent

lower inflation in the US economy is not transitory.

An environment of lower USD, lower US rates, lower inflation and

a decent real wage growth may be good for the US economy & the stock

market; it’s like a goldilocks situation!! All the three main US stock indexes

closed in another record trifecta; DJ-30 closed around 0.18% higher,

S&P-500 edged up by almost 0.20% to close at 2555, while NQ-100 gained by

almost 0.30%.

Overall, yesterday US market was supported by techs and some

defensive bets like McDonald, J&J along with some other names like Black Rock,

Delta Airlines on upbeat Q3 results. But overall market mood was quite cautious

ahead of earnings dump by various big names in banks & financials coupled

with fresh NK saber-rattling.

US stock future (SPX-500) is now trading around 2553, almost flat ahead of EU market

opening. Looking ahead, technically,

SPX-500 need to sustain above 2565 zone for further rally towards 2580-2595

& 2620 area; otherwise it may come down and sustaining below 2540 area, may

further fall towards 2525-2510 & 2485 zone in the coming days.

USDJPY is now trading around 112.30, down by almost 0.14% on renewed

NK rhetoric and dovish FOMC minutes.

In brief, majority of the FOMC are concerned about US inflation

“mystery” and its consistent subdued nature, although they are quite upbeat

about US job market and believe that it will ultimately push wage growth,

higher consumption & inflation, paving the way for more rate hikes or

monetary policy normalization.

Although Dec’17 rate hike may be almost certain now considering

Fed’s credibility, 2018 dot-plots may be in doubt for muted US inflation, mixed

economic data, uncertainty about Fed leadership after Yellen, who is set to

exit by March’18 and poor visibility of Trump’s fiscal stimulus package. FFR is

now showing around 80% probability of a Dec Fed rate hike despite yesterday’s

dovish FOMC minutes.

In reality, Fed will wait for financial market reaction, if any

for its ongoing BS tapering effect, which is slated to start from this month

and also watch the dual QT (Dec rate hike & QE tapering) for another

quarter till March. If everything is fine, then Fed may go for another 2-3 rate

hike in 2018 to bring the Fed rate at around 2.00-2.25% form present 1.25% (3-4

hikes from Dec’17 to Dec’18). Thus RRI for US may be around 0% by 2018, if CPI

also moves around 2% by then and this will be a “new normal” for US economy.

USD was under further pressure early in the Asian session today,

when NK Foreign Minister again issued

some fresh rhetoric by commenting that Trump has “lit the fuse (wick) of

war” with NK by his “bellicose & insane” statements at UN labeling Kim as

“rocket man”. The NK foreign minister further went on by saying that all the

North Koreans wish to “settle the final score” with the Americans only with a

“hail of fire & not words”.

All eyes are now on Trump’s tweeter handle for his counter

rhetoric in this epic game of chickens; but it may be also a great instrument

for Trump to keep USD down despite Fed is going for dual QT. Thus the NK

hangover may continue in the days ahead despite some serious diplomatic effort

by China & Russia and also by a former US Prez (Jimmy Carter) to resolve it

for permanent “peace”.

NK will never abandon its Nuke ambition as it’s an insurance against

any US-SK attack and US will never accept a “nuclear” NK, capable of hitting US

mainland with its ICBM. Thus the “war of words” will continue until any serious

mis-steps by NK or US. USD was also on pressure yesterday after subdued JOLTS job openings report for

Aug, one of the favourite indicator for Yellen.

Meanwhile, EUR is gaining

strength on hawkish scrips by ECB and hopes of an imminent & inevitable

QE tapering and policy normalization, despite Catalonian political uncertainty

and duet between Madrid & Barcelona. As par latest report, Spanish

authority has given 5-8 days to Catalonian autonomous authority to explain

their “independence” bid and to cancel it with clear languages.

It’s now clear that Spanish PM is not interested to negotiate

with Pro-Independence Catalan autonomous authority/party and is dealing with

the whole situation very strictly to keep Spain as united. But, domestic

political compulsion of Catalan may also force them not to budge too much and

thus this political uncertainty in Spain will go on in the days ahead.

Again, strict stance taken by the Spanish authority may be also

good for the EUR as there is no immediate chance of any extreme step

(secession) by Catalonia. But, a higher EUR is not good for the export heavy EU

economy & the market.

Overall, global market is upbeat for earnings and PMI data optimism despite ongoing

geo-political tensions in NK & Catalonia.

Elsewhere, Australian

market (ASX-200) closed around 5794, up by almost 0.40% despite higher

AUDUSD and some fall in iron ore prices today, generally bad for export heavy

AU market was today helped by utilities, IT/techs, industrials, energies, banks

& financials, consumer staples, health care & property developers,

while dragged by basic materials & resources (mining stocks).

AUDUSD is now trading around 0.7834, up by almost 0.40% on broad

weakness in USD after dovish FOMC minutes coupled with upbeat AU home loan data

for Aug and upbeat GDP forecast by IMF day before yesterday. Iron ore is down

amid concern of slower demand from China in winter season as Govt is clamping

down on zombie steel producers to make sure that China got a clear smog free

blue sky this winter.

Japan (Nikkei-225) closed around 20955, up by almost 0.35% at another mile stone

multiyear record high on Q3 earnings optimism and hopes for a clear win by Abe,

positive for JP monetary stimulus addicted market. JP market was today helped by

health care, techs (Soft Bank), mixed exporters (slightly lower USD), while

dragged by automakers (Kobe auto steel quality issues), banks & financials

& energies. Scandal ridden Kobe steel today recovered by almost 1% after

two days slump.

Today’s overall JP economic data was mixed; PPI was in line with

market estimates, while bank lending (credit growth) came as upbeat, but

industry activity index flashed as subdued. Generally, JP economic data does

not affect USDJPY in a big way.

China (SSE) closed around 3386, down by almost 0.10% bucking the overall

regional trend on concern of any fresh policy tweaking in the forthcoming twice

a decade party congress. Today China market was helped by defence stocks on SOE

reform hope and yesterday’s US nay/warship entering into the South China Sea

news, while it was dragged by basic resources/miners/commodities (production

cuts to prevent winter air pollution) & energy related shares (lower oil).

Overall market move may be cautious as all focus now on ant

policy clarity or fresh reform measures in the party congress along with deluge

of Q3 earnings. Today PBOC Gov has signalled for some imminent financial reform

announcement on foreign investment liberation and removal of capital control on

out ward remittances by FPIS.

PBOC today fixed mid-point of USDCNY at 6.5808 vs 6.5841,

marginally lower with a net drain of40 bln Yuan by its daily OMO.

Hong-Kong (HKG-33) stock

future is now trading around 28425, up by almost 0.40% after yesterday’s sudden

fall on muted policy speech by the HK CEO. Today HK market is being helped by

tech/internet stocks (Tencent), banks & insurers, automakers, gaming stocks

(Macau on upbeat earnings forecast), mixed property developers, while dragged

by energies.

Meanwhile Crude Oil (WTI)

is now trading around 50.95, down by almost 0.68% on surprised stock glut in

the API report; all eyes now will be on the official EIA report later in the day

amid ongoing OPEC jawboning for a faster rebalancing and geo-political tensions

in Kurdish region.

Technically, WTI now need to stay above 51.60 area for further rally

towards 52.75; otherwise it will come down and sustaining below 50.00, it may

further fall towards 48.90-47.85 area in the days ahead.

EU Market Is Trading Mixed Despite Upbeat Global Cues & Lower EUR

Amid Catalan Uncertainty; EU Stocks Are Dragged By Banks On Lower Bond Yields

EU stocks are now almost flat in Stoxx-600, up marginally by

0.04%; DAX-30 is edged up by around 0.20%; CAC-40 edged down by almost 0.05%, FTSE-100

has gained by 0.27%, while IBEX-35 is down by around 0.25%.

Overall, EU market is being affected by ongoing

Catalan political uncertainty and also being dragged by banks & financials

on lower US/EU bond yields after a dovish FOMC minutes; lower bond yields are

negative for business models of the banks. EUR is also being affected by

Catalonia issue and subdued inflation or rather than deflation in France ahead of

Draghi & tomorrow’s EUR/German CPI.

Although, Catalan leaders have dialed back their “immediate”

independence bid, the issue is far from over and is shaping into a major

political headwind for Spain. As par latest report,

Spanish authority has given 5-8 days to Catalonian autonomous authority to

explain their “independence” bid and to cancel it with clear languages;

otherwise Spanish authority may suspend Catalan autonomy and rule the region

directly.

Thus, the duet between Madrid & Barcelona is far from over

and It’s now clear that Spanish PM is not interested to negotiate with Pro-Independence

Catalan autonomous authority/party and is dealing with the whole situation very

strictly to keep Spain as united. But, domestic political compulsion of Catalan

may also force them not to budge too much and thus this political uncertainty in

Spain will go on in the days ahead. Thus Spain

market (IBEX-35) is in renewed pressure today.

DAX-30 is being helped by airlines consolidation; Lufthansa signed a

deal to buy insolvent German carrier Air Berlin. Also, another airlines stock, Easyjet

is upbeat (another potential bidder of Air Berlin). Volkswagen also helping the

German market on analyst upgrade.

FTSE-100 is being helped by some fall in GBP amid talks of a “Hard

Brexit”; UK may be preparing to exit EU without any deal at all; a lower GBP is

good for export heavy FTSE !!

Today, UK market is being helped by Sky TV (upbeat earnings)

& Just Eat (approval of M&A deal), while it was dragged by Stanc on IMF’s

guidance warning about Asia focused banks coupled with concern for stretched

valuations. Overall EU market sentiment

may be also cautious on Q3 earnings trajectory amid strong EUR, negative for

the export heavy EZ market.

USD Edged Down As Fed's Inflation Debate Heats Up:

SGX-NF

BNF

GBPUSD

No comments:

Post a Comment