Market Wrap: 18/10/2016 (17:30)

For real strength, SPF

(LTP: 2136) need to sustain over 2140-2160 area and for NF, it will be above

8755-8785 zone; otherwise it may be proved as "dead cat bounce"

again.

GST TAX SLABS (PROBABLE)-COURTESY- BS

Nifty

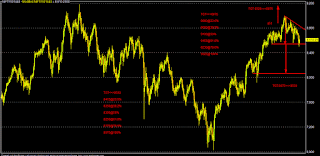

Fut (Oct) today closed around 8675 (+1.77%) after making an opening low of 8560

and late day session high of 8687 supported by positive global cues led by weak

USD and short covering after recent steep correction of around 5.5% in Nifty

(around 500 points) in the last few weeks.

Technically,

for tomorrow (19/10/2016), NF has to sustain above 8700-8720* area for further

rally towards 8755*/8785-8815/8875-8925/8975 zone in the immediate to short

term.

On

the other side, sustaining below 8670-8635* area, NF will gain some weakness and

may further fall towards 8595/8560-8545/8500*-8465/8405 zone in the immediate to

short term.

Overall,

for any "Pre-Diwali rally", NF need to sustain over 8755 area

for Diwali target of 9075-9200 area; otherwise it may again fall towards 8545

area and consecutive closing below that we may see "Diwali sale"

towards 8300-8050 territory due to various global "event risk" in

late Oct-Nov.

Today

Indian market opened in positive note amid supporting global/Asian cues.

Yesterday's US economic data (Empire MFG/IIP/Capacity

utilization) were all below/at par market expectations and not good at all,

except IIP, which showed some strength after long time.

This may also

highlights the tepid consumer spending because of strong currency for the

US economy (USD) and together with Yellen's comments day before yesterday about

allowing "US economy to run a little hot"; i.e. Fed may tolerate

higher CPI and may not take much hawkish stance in 2017, after the Dec'16 rate

hike.

Yellen has also spoken about steepening of long end US TSY yields

by some mechanism of tweaking (like BOJ) and together with all the recent Fed

official's comments about monetary policy, market is gearing itself for a

probable Dec rate hike, despite some optimism that going forward Fed may be

quite accommodative and dovish in actual action, until at least Dec'17.

Thus, going forward, market may be assuming that Fed will hike

only once a year (every Dec ??) in order to keep everything in balance (various

geo-political & global economic risks and of course "Trumpism") and just to ensure that it does not

fall behind the curve & to keep its own credibility.

Globally, all eyes will be on the US core CPI today, which is

expected to be 0.3% (MOM) & 2.3% (YOY) against Fed's own long term average

target of 2%. Any core CPI number above 2.3%-2.5% may again ignite the USD

today, because there will be even higher probability of Dec'16 rate hike by

Fed. Presently, FFR indicating a higher probability of 70-73% for Dec rate

hike.

Although, oil was

under pressure yesterday for Iran's comments about production level and ongoing

doubt about real effectiveness of OPEC's production cut/freeze proposal, it

rebounded again in the early Asian session today because of weak USD & some

reports about early re-balancing of demand & supply (of course with caveat

of successful OPEC production cut/freeze in Nov).

On the ongoing Brexit saga, all eyes now is on the British judiciary, where a plaintiff complaint about demand for UK parliament approval for invocation of Artcle-50/Real Brexit is being heard. Any favourable verdict by the High Court there may ignite GBP, but even if so (chances are remote that Judiciary will interfere in the UK politics/Lisbon treaty now), it will be certainly challenged in the Supreme Court there and all these may linger the process of actual exit & further extension of the current environment of uncertainty in UK/global market. As par former ECB official, EU may be a “House of Cards".

Tomorrow morning all eyes will be on China GDP (estimate 6.7%; prior 6.7%) and IIP (estimate 1.8%; prior 1.8%) in order to assess the underlying strength of the World's 2-nd largest economy, which is transforming itself steadily from a manufacturing based economy to a more consumption & service oriented economy and also undergoing some structural measures to reduce over capacity and debt as well as growing bubbles in the property market. Any jitters in China may turn into a much bigger snow ball for the global market & risk trade.

Among all these ongoing global cues, Indian market sentiment today got some boost over the progress of GST & some reports that India's CAD may stay below 1% of GDP in FY-17 supported by sharp fall in trade deficit this year. But it also cautioned against sudden ballooning of trade deficit because of risk of tepid trend of service sector receipts coupled with private transfers (NRI remittances).

As par some report, although there may be a GST meet on 20-th Oct to finalize the rate, it may not be possible for a consensus among all the states. Govt may propose 18% RNR, while states are demanding 22%, keeping in view that there will be not any net revenue loss for the states.

On the ongoing Brexit saga, all eyes now is on the British judiciary, where a plaintiff complaint about demand for UK parliament approval for invocation of Artcle-50/Real Brexit is being heard. Any favourable verdict by the High Court there may ignite GBP, but even if so (chances are remote that Judiciary will interfere in the UK politics/Lisbon treaty now), it will be certainly challenged in the Supreme Court there and all these may linger the process of actual exit & further extension of the current environment of uncertainty in UK/global market. As par former ECB official, EU may be a “House of Cards".

Tomorrow morning all eyes will be on China GDP (estimate 6.7%; prior 6.7%) and IIP (estimate 1.8%; prior 1.8%) in order to assess the underlying strength of the World's 2-nd largest economy, which is transforming itself steadily from a manufacturing based economy to a more consumption & service oriented economy and also undergoing some structural measures to reduce over capacity and debt as well as growing bubbles in the property market. Any jitters in China may turn into a much bigger snow ball for the global market & risk trade.

Among all these ongoing global cues, Indian market sentiment today got some boost over the progress of GST & some reports that India's CAD may stay below 1% of GDP in FY-17 supported by sharp fall in trade deficit this year. But it also cautioned against sudden ballooning of trade deficit because of risk of tepid trend of service sector receipts coupled with private transfers (NRI remittances).

As par some report, although there may be a GST meet on 20-th Oct to finalize the rate, it may not be possible for a consensus among all the states. Govt may propose 18% RNR, while states are demanding 22%, keeping in view that there will be not any net revenue loss for the states.

Thus there may be

another meeting to finalize the GST rates (RNR & others) before Winter

Parliament session next month. Keeping all the views in mind, a RNR of 20% may

be accepted both by centre & the states; but there may be some political

dead lock in actual passage of the same in the Winter session of Parliament and

implementation from Apr'2017 because of various political games just before the

UP & other state elections.

As par some experts, four rates of GST may invite more complications and compliance issues and the concept of "one nation one tax" may be in jeopardy as well.

Market today also

supported by Bank Nifty after the recent Essar M&A, which may pave the way

for more such deleveraging activity and ease the burden of stressed assets on

the Indian banking sector.

Overall, today's much anticipated rally may be because of short covering after the recent spate of correction. Globally, S&P Fut is also rallying today ahead of important economic data & ECB meet.

Overall, today's much anticipated rally may be because of short covering after the recent spate of correction. Globally, S&P Fut is also rallying today ahead of important economic data & ECB meet.

SGX-NF

GST TAX SLABS (PROBABLE)-COURTESY- BS

No comments:

Post a Comment