Market Wrap: 20/03/2018

NSE-NF (March):10159 (+36; +0.36%)

NSE-BNF (Jan):24280 (-57; -0.23%)

Valuation metrics:

NS: 10124; Q2FY18 EPS: 410; Q2FY18 PE: 24.69; Avg FWD PE: 20; Proj FY-18 EPS: 418; Proj Fair Value: 8360

BNS: 24168; Q3FY18 EPS: 822; Q2FY18 PE: 29.40; Avg FWD PE: 20; Proj FY-18 EPS: 961; Proj Fair Value: 19220

For 21/03/2018:

Updated: 08:05

SGX-NF: 10165; (+6; +0.05%)

Expected BNF opening: 24300 (+0.05%)

(Almost flat on positive global/US cues after soft US trade protection tone in the G-20 meet and tech tantrum coupled with higher oil, helpful for energies stocks)

March-Fut (Key Technical Levels)

Support for NF:

10120/10070-10030/9995*-9970/9950-9880/9815

Resistance to NF:

10205/10250*-10300/10350-10405/10450-10495/10530

Support for BNF:

24050-23950*/23850-23600/23400-23150/23000

Resistance to BNF:

24550/24700-24850*/24950-25100/25250-25400/25600

Technical View (Positional):

Technically, Nifty Fut-Jan (NF) has to sustain over 10205 for a further rally towards 10250/10300-10350/10405-10450/10495 in the short term (under bullish case scenario).

On the flip side, sustaining below 10185 NF may fall towards 10120/10070-10030/9995-9970/9950-9880/9815 in the short term (under bear case scenario).

Technically, Bank Nifty-Fut (BNF) has to sustain over 24550 for a further rally towards 24700/24850-24950/25100-25250/25400 in the near term (under bullish case scenario).

On the flip side, sustaining below 24500-24250, BNF may fall towards 24050/23950-23850/23600-23400/23150 in the near term (under bear case scenario).

The Indian market story on 20/03/2018:

The Indian market (Nifty Fut-March/India-50) closed around 10159 on Tuesday, edged up by almost 0.36% on positive global cues and buzz of increase in FII limit in the Indian government bond (GSEC) markets. Nifty Future made an opening minutes low of around 10078 on overnight subdued cues from US market, but subsequently rebounded and made a late day high of 10185 on positive Asian as well as European cues coupled with some positive domestic cues.

The Indian government is also ready to launch SDF (standing deposit facility) by Sep’18 to ease the tighter liquidity (bond market) conditions in the banking system and has also assured that the economic reform agenda is on track, although the present Parliamentary ruckus may delay passage of some bills.

The great Indian political drama continues:

But there was also some pressure in the market amid ongoing political saga in the Indian Parliament. Although TDP, a key former NDA ally has supported the “no-confidence” motion moved by YSR and also almost all the other opposition & regional parties are supporting it for their own political compulsion, this may be a symbolic move and there is no threat on the government.

But the market may be quite nervous on the Parliament floor strategy of the BJP/NDA government to not allow the “no-confidence” political debate and adjourn the Parliament repeatedly, which in effect may also stall some of the important bills to pass.

Goldman Sachs has downgraded the Indian GDP for FY-19 on tighter banking credit:

After the market hours, Goldman Sachs (GS) downgraded the Indian GDP to 7.6% from earlier 8% for FY-18 on account of PNB loan fraud, which may spark tighter banking regulation and constrain credit growth & private capex. But GS, which forecasts the Indian economy to grow 6.6% in the current fiscal year (FY-18), said it retained its FY-20 growth forecast at 8.3%.

As par GS, the PNB case, along with a flurry of smaller loan frauds since reported by other banks, has sparked new concerns that credit growth is unlikely to pick up quickly in an economy where state-run lenders that account for two-thirds of banking assets are already saddled with a mountain of bad debt.

The GS warning may be a blow for the Modi government, which had hoped that a $32 billion, two-year, bank recaps program it unveiled last year would help Indian public sector banks (PSBS) to begin to restart lending, spurring elusive job growth in the economy.

PSBS account for the bulk of the close to $150 billion of soured debt in India. They have already seen the amounts they must set aside to cover bad debts grow due to new RBI rules, and are staring at further loan losses as they pursue a host of defaulters through the bankruptcy court and complex IBC rules, embroiled with NCLT cases.

GS said it feared a regulatory crackdown after the huge PNB fraud, and the mountain of soured debt, could increase Indian banks’ provisioning burden and so slow credit growth. As par GS, markets and investors are questioning whether the problem of PNB fraud is more systemic, which will eventually offset some of the positive effects of the bank recapitalization and hit overall credit, investment and GDP growth of the economy.

GS believes that PNB was likely to take the hit of the entire $2 billion, wiping off more than a quarter of its net worth. It also said the average haircuts on impaired loans Indian banks would need to take could be 60-65% over the next two years, higher than the 50% it had assumed earlier, meaning overall provisions would rise.

The still-unraveling PNB fraud, the biggest in India’s banking history, has prompted the government to ask banks to scan all their bad loans above Rs.500 million for any sign of wrongdoing or fraud. Other small cases of fraud have come to light in the past month, while investigations into ongoing cases have picked up the pace and also affecting some other PSBS & private banks.

The Indian NPA saga continues:

On Tuesday, Canara Bank, another PSB, tumbled as much as 5.4% after the police arrested its former chief and others over allegations that the officials helped a company defraud the bank of about Rs.4 bln taken in loans over four years ago.

Another such suspected loan fraud case may be brewing at ABG Shipyard, which owes more than Rs.16.4 bln to various Indian banks including ICICI, SBI, IDBI, PNB. Now Banks is not finding any eligible bidder for the ABG, even at throwaway liquidation price of Rs.2.2 bln. There were also other issues of due diligence with the company.

The market may be also concerned at the slow pace of NCLT resolutions for NPA and the ultimate recovery for the banks as its being marred by various legal hurdles and cases. Prospective investors/bidders of such stressed assets may be very disappointed over such legal hurdles in every resolution step, as they have come to invest and not to contest in court cases.

On Tuesday, Indian market was helped by PSBS, automakers, financials, FMCG, techs/pharma (exporters- higher USDINR), media, pharma, consumption, and infra, while dragged by private banks, metals, reality, and energies.

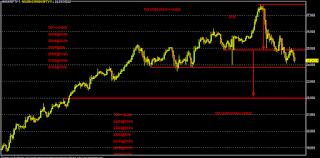

SGX-NF

BNF

USDJPY

No comments:

Post a Comment