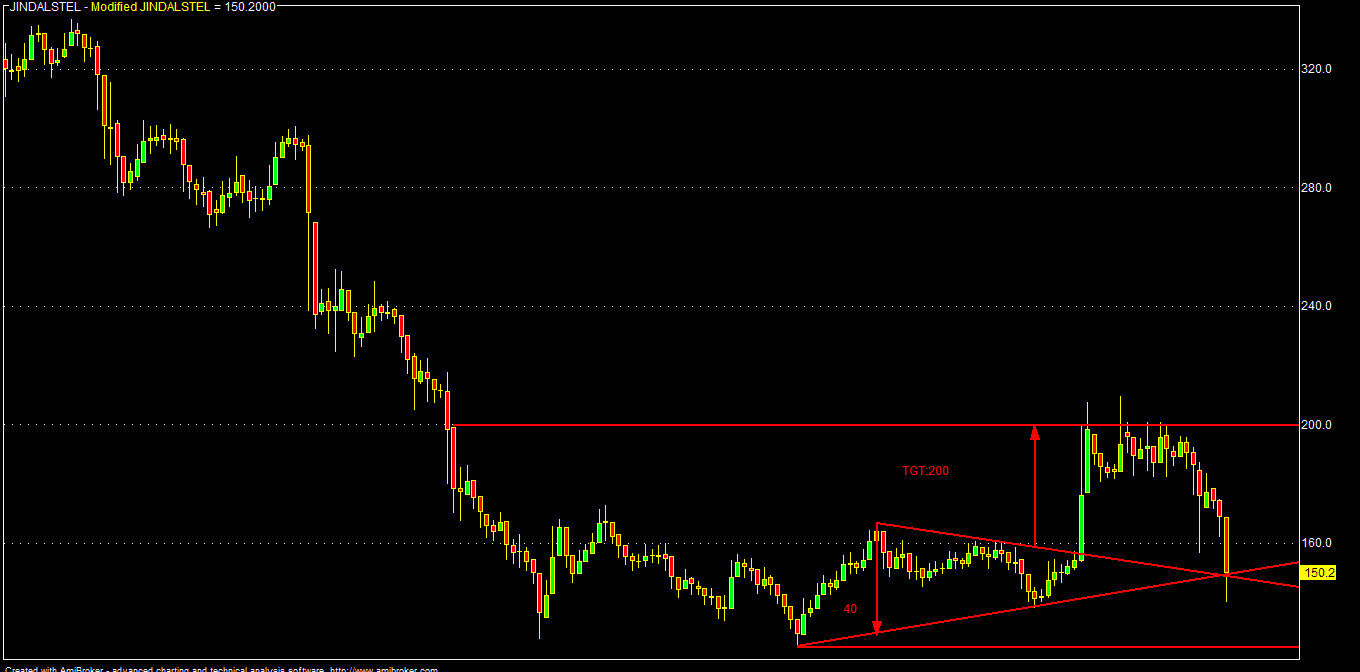

Technically, JSPL (CMP:154) has immediate positional support zone of 137 & 125-119 zone. Sustain below 119, it could dip to 105-88 zone (low probability as of now).

On the up side, sustain above 153, it will gain momentum and may target 182-210 zone in the immediate to short term. Consecutive closing above 210, it could move to 255-328 zone in the mid-long term, but for that, issues about its key coal block allocation fiasco has to be resolved in its favour.

JSPL may be one of the beneficiary of the infrastructure push story in "Shinning India".

But, it is one of the biggest looser since the SC verdict on coal block allocation around Aug'2014. Recent key coal block (For JSPL) de-allocation fiasco in auction also added further slide in its stock price yesterday. But, as expected, the Company moved HC swiftly on yesterday itself and able to successfully procure an interim stay on the de-allocation order of the Govt, which means that the present statusco of the the controversial key coal mines will remain with JSPL, until the HC heard the matter in full & give its final judgment.

Eventually, this particular issue & all the other related issues may go the SC, from where we could find an acceptable solution for all the concerned in the larger interest of India's growth story.

Ultimately, availability of coal (fuel) at affordable price is key to power & steel production of many corporates, including JSPL and this is an vital issue for our fragile infrastructure and confidence of investors in the policy matter of our Govt.

At this point, except clarity about this coal block allocation issue, all the other fundamental matters are irrelevant.

No comments:

Post a Comment