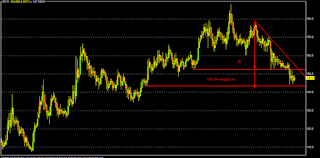

Technically, IDFC (CMP:147) has immediate support of around 144-140 & sustain above 144, its immediate target may be 151-156, followed by 162-167-171 zone in the short term. Consecutive closing above 171, IDFC may target 178-188 area in the mid term. In the long term, only sustaining above 188, it may scale 205-235 & 295 territory (@IDFC Bank; FY:16-18) in the bullish case scenario.

On the downside, sustain below 140, immediate target may be 135-132-130 zone. Consecutive closing below 130, IDFC may further fall to 125-120-115-110-100 & 88-76 in the worst bear case scenario.

In the near term, strong demand (support) zone may be 144-130 and good supply (resistance) zone may be defined as 171-178.

Bottom Line: Technical Trading Levels (Positional)

| SL</>2 | FROM SLR | |||||||||

| IDFC | CMP | 147 | ||||||||

| T1 | T2 | T3 | T4 | T5 | T6 | T7 | SLR | |||

| Strong > | 144 | 151 | 156* | 162 | 167 | 171* | 178 | 188-205 | <140 | |

| Weak < | 140 | 135 | 132-130* | 125 | 120 | 115* | 110 | 100-88-76 | >144 | |

IDFC will shortly launch (on a pilot project basis) its banking operations before starting full-fledged operations in Oct'15, by launching almost 20 branches in several district towns of MP. As par management guidance, it has chosen the initial state of MP primarily because of three factors (competition, infrastructure & agriculture). IDFC Bank will have one set of branches in every metro cities and the other set will be in every important district towns. It will mainly concentrate on digital platform rather than investing heavily on B&M branches with tech savvy mobile sales force supported by dedicated customer relations personnel.

Being an existing infrastructure finance company (like ICICI Ltd before launching its bank in 1994), IDFC has already substantial business in whole-sale banking category which may be of immense helpful for it from day one to generate significant profit as IDFC Bank.

Going ahead, IDFC will mainly focus on retail banking & micro-finance. But mandatory priority sector lending may be a challenge for the IDFC Bank. Rating agency FITCH recently retains its existing 'BBB-' rating on IDFC, despite some asset quality risks. But its foray into banking operations will likely improve its overall credit profile along with its strong capital base. Presently, the spurt in asset quality stress in infrastructure segment is hurting the overall banking/non-banking lenders, including IDFC & its NPA/restructured assets deteriorates to some extent in Q4. The stock price has suffered recently due to some issue with its forthcoming NCD, banking operations launching uncertainty in Oct amid stressed assets apart from overall market scenario.

The pace of overall economic recovery will be gradual & slow and by H2/FY-16, we may see visible improvement. Along with this, expected push in infrastructure in coming days, thanks to "Modinomics", IDFC Bank may be one of the future bright spot in the banking space in the days ahead.

As par quick BG metrics, current median valuation of IDFC may be around 132 & its (As IDFC Bank), projected fair valuation might be around 195-225 (FY:16-17).

| SCRIP | EPS(TTM) | BV(Act) | P/E(AVG) | LONG TERM | SHORT TERM | MEDIAN VALUE | 200-DEMA | 10-DEMA |

| IDFC | 10.96 | 94.87 | 10.26 | 132.51 | 129.76 | 131.13 | 156.14 | 149.73 |

| IDFC | 11.74 | 103.6 | 20.36 | 193.19 | 189.18 | 191.18 | 156.14 | 149.73 |

| IDFC | 16.65 | 113.1 | 20.36 | 230.07 | 225.29 | 227.68 | 156.14 |

No comments:

Post a Comment