Updated: 09:00

SGX-NF:

11425 (+8; +0.07%)

Expected BNF opening: 27966 (+30; +0.10%)

SPX-500: 2845 (+0.25; +0.01%)

Fut-I (Key Technical Levels)

Support for NF:

11400/11365*-11330/11290-11265/11225-11200/11175

Resistance to NF:

11495/11515*-11550/11585-11605/11665-11695/11725

Support for BNF:

27825/27640*-27400/27250-27000/26900-26700/26500

Resistance to BNF:

28100/28175*-28300/28450-28525/28685-28800/29100

Support for SPX-500:

2840/2815*-2800/2790-2770/2735-2720/2695

Resistance to SPX-500:

2865/2880-2905/2925-2960/3010-3035/3070

Technical

View (Nifty, Bank Nifty, SPX-500):

Technically, Nifty Fut-I (NF) has to sustain over 11515 for a

further rally to 11550/11585-11605/11665-11695/11725 in the near term (under

bullish case scenario).

On the flip side, sustaining below 11495-11475 NF may fall to 11400/11365-11330/11290-11265/11225

in the near term (under bear case scenario).

Technically, Bank Nifty Fut-I (BNF) has to sustain over 28175

for a further rally to 28300/28450-28525/28685-28800/29100 in the near term (under

bullish case scenario).

On the flip side, sustaining below 28125-28100/28050, BNF may fall

to 27825/27640-27400/27250-27000/26900 in the near term (under bear case

scenario).

Technically, SPX-500 has to sustain over 2865 for a further rally

to 2880/2905-2925/2960-3010/3035

in the near term (under bullish case

scenario).

On the flip side, sustaining below

2855 SPX-500 may fall to 2840/2815-2800/2790-2770/2735 in the near term (under bear case

scenario).

Valuation metrics:

Nifty-50: 11385; Q4FY18 EPS: 402; Q4FY18 PE: 28.32;

Avg FWD PE: 20; Proj FY-19 EPS: 425; Proj Fair Value: 8500

Bank Nifty: 27827; Q4FY18 EPS: 519; Q4FY18 PE: 53.62;

Avg FWD PE: 20; Proj FY-19 EPS: 961; Proj Fair Value: 19220

SPX-500: 2841; TTM Q4-2017 EPS: 111; TTM PE: 25.60

GLOBAL MARKETS UPDATE: iforex.in/news

FOLLOW ME: twitter.com/ASISIIFL

NIFTY-SGX-NF

BANK NIFTY-BNF

SPX-500

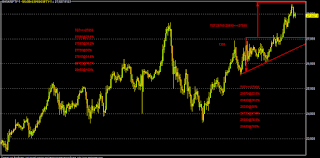

USDJPY

EURUSD

GBPUSD

No comments:

Post a Comment