Technically, ASL has to sustain above 108-115 zone for target of 122-125 & 135 area; otherwise it will face selling pressure and sustain below 105-98 zone, may again fall towards 90-84-77 territory.

Incremental benefit of demands from replacement market & regulatory requirements for MHCV segment may be limited in the days ahead and will depend up on the actual recovery in capex and investment cycle in India.

Trading Idea: Ashok Leyland

CMP: 106

Either sell below 108 or on rise around 112-115-122;

TGT: 98-95*-90-84*-77-65 (1-3/6M)

TSL> 125

Note: Consecutive closing (3 days) above 125 for any reason, ASL may further rally up to 135 in the near term.

ASL made a life time high of around 106 yesterday and moreover rallied around 36% from Mid-Feb'16 low of 78.

Apart from the budget & G-4 (Fed/ECB/BOJ/PBOC) induced general market rally for the last few weeks, some of the reasons for the massive 36% rally in ASL may be attributed to:

Over 50% & 75% increase in investments in road construction and defense MHCV in the 2016 budget is positive for MHCV makers including ASL. The change in MV act along with scrapping of permit systems & old vehicles replacement incentives are also positive for the sector as this may increase the demand by 10-15%.

Significant growth in MHCV segment (both truck & buses), which account around 80% for ASL top line and it commands a market share of around 32%. Also ASL doing well in LCV segment and analysts are expecting a 10% CAGR for the segment on the back of lower/stable diesel prices and increase interests/profitability of fleet operators/logistics.

But analysts are also attributing to the fact that most of the demands for trucks are coming from replacement market because of old age vehicle issues (NGT), specially from NCR regions, where 15 years old trucks are banned. So, once this demand of replacement markets get exhausted, we may not see the incremental growth of 25-35% (on YOY basis), specially in the absence of any visible economic/industrial recovery in the near future.

The same factor (replacement demands and regulatory changes) is partially true for the buses also.

In MHCV, H2FY16 volume growth of ASL is around 78% against industry growth of 44%. The strong volume & OPM growth was also attributed to price increase owing to regulatory requirement (like ABS, Speed Control Device, BS-IV compliant vehicles).

But going forward, incremental growth in sales for these regulatory requirements may come towards a saturation point and there may not be the benefit of lower base effect in the coming quarters.

Also there will be intense & growing competition from Bharat-Benz, Volvo-Eicher, MTBL (M&M) apart from Tata Motors. So Q2FY16 EBITDA of 10% will be difficult to maintain and benefit of incremental lower input costs (commodity raw materials) may also be not there. Q3FY16 EBITDA margin was around 7.8% although it was around 4.1% YOY. Despite 1.5% price hike in Q2, product discount may be continue to be higher in the range of 2-2.5 lacs/unit.

Thus looking ahead, incremental earnings growth of ASL may be limited despite the management's focus on R&D (new product development), network expansion (both domestic & international market), cost cutting and domestic growth led by replacement/regulatory & mining/infra sector demand and MHCV Bus orders under STU/JNNURM schemes.

Apart from the MHCV segment, ASL management is also relying on export and defense as another major growth driver and projected around 33% of revenue from these sector in the medium term.

Infact, ASL/ALDS is the largest provider of logistics vehicles for the Indian Army (IA) and also has a strong portfolio in the defense sector.

Recently it signed an agreement with US based Lockheed Martin (LM) to develop light combat vehicles for the IA and make India a manufacturing & export hub for the Light Specialist Vehicle (LSV) and Light Armoured Multipurpose Vehicle (LAM) of "high quality in a cost effective way" using the platform of LM's high mobility vehicle or Common Vehicle Next Generation (CVNG).

The IA does not have such LAM/LSV at present and now using primarily a heavy vehicle (Stallion, which is also made by ALDS) for all purposes. IA was planning to add these light vehicles for the last 7-8 years and finally the tender came in last year for 1300 LSV and 700 LAM (s) worth about $1 bln (first time order) and winner of this contract, will have the opportunity to supply the IA for the next 15-20 years. ALDS is expecting that with the proven technology of LM at Indian cost (low) with localization & required modification (as par Indian requirement), it will be able to win this IA light vehicles contract.

But, there will be intense competition among the defense players for this IA tender and even if ALDS can procure the full contracts of the LSV/LAM (s), its effect on the net earnings (bottom line) may be reflected only after 3-5 years later.

Looking ahead, the projected defense spending and DPP using "Make In India" theme may also depend upon the Govt's fiscal plan or capex ability and the market may like to see it in reality.

Another point is that "defense" is a sensitive & political issue for many advanced nations and they will not compromise any quality for the sake of some cost cutting. There is a virtual monopoly for US, Russian companies in the global defense market and Israel, France are also strong players.

Any country may think twice before buying sophisticated defense parts having "Made In China" or "Made In India" tag. So, any significant defense exports from India may take considerable time for a visible impact in the bottom line of the defense companies here.

ASL is also in the process of terminating JV agreement with John Deere (construction equipment) and Nissan (CV/Power Trains/Technology), which may have some negative implications for the ASL in future.

Considering all the above positive news flows for the ASL and its recent price action, the scrip may be largely discounted and now technically may be in a good supply zone.

For ASL:

Actual TTM EPS: 3.08

Projected FWD EPS: 3.60-4.40-5.20 (FY:16-18)

Average PE: 25

As par BG metrics & current market scenario:

Present median valuation may be around: 85 (FY:15/TTM)

Projected fair valuations might be around: 90-100-110 (FY:16-18/FWD)

| SCRIP | EPS(TTM) | BV(Act) | P/E(AVG) | Low | High | Median | 200-DEMA | 10-DEMA |

| ASHOKLEY | 3.08 | 14.4 | 25 | 81.03 | 87.27 | 84.15 | 85.28 | 98.9 |

| ASHOKLEY | 3.6 | 16.95 | 25 | 87.61 | 94.35 | 90.98 | 85.28 | 98.9 |

| ASHOKLEY | 4.4 | 20.05 | 25 | 96.85 | 104.30 | 100.58 | 85.28 | 98.9 |

| ASHOKLEY | 5.2 | 25.05 | 25 | 105.29 | 113.39 | 109.34 | 85.28 | 98.9 |

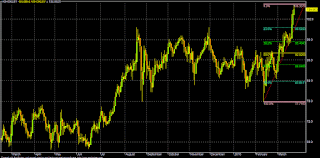

Analytical Charts:

No comments:

Post a Comment