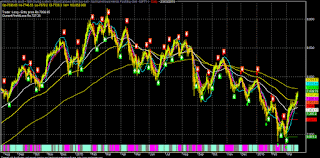

Technically, NF need to sustain above 7760-7825 zone for further rally up to 7915-8005; otherwise we may see some selling pressure and sustain below 7672-7632 it may fall towards 7560-7415 zone again.

Trading Idea: Nifty Fut (Mar)

SGX-NF: 7690 (LTP)

NSE-NF: 7728

Either sell below 7710-7760 or on rise around 7800-7825;

TGT: 7672-7632*-7560-7485-7415*-7365-7300-7240 (1-5 days)

TSL> 7860

Note: Consecutive closing (3 days) above 7860 for any reason, NF may further rally up to 7915-8005 & 8055-8100 zone in the near term (alternative bullish case scenario from the present trading level).

NF made a smart rally of more than 900 points (13%) from the budget day low in a span of less than 30 trading days. As the budget delivered not so much negativity as feared by the market ( specially no change in LTCGT and service tax), market recovered on the back of massive short covering/some value buying. Global market (SPF) also recovered by more than 13% from the Feb'16 low after G-20 meeting and some apparent co-ordinated action by 4 major central bankers of the world (PBOC/BOJ/ECB/Fed) in the last few weeks.

Fed was more than dovish than the market expected and FFR is now basically indicating only 1 rate hike probability in Dec'16. But, in the last week, after series of Fed speakers (drama), USD gained some strength as talk of April "live meeting" or June hike possibility again resurfaced. Also, Fed transcript of press conference after March Fed meet is causing some confusion regarding the possibility of every meeting being "live or dead" !!

Last Friday's data of US GDP (Q4 revision) was at 1.4% against expectation of 1%. Though this GDP is pointing towards no apparent recession in US as feared by the market, but falling corporate profitability (core) may be a concern.

Apart from China, Oil, Brexit, possibility of Trump being the next US president may be a major headwind for the "risk on" rally as USD will gain more strength.

Thus Fed may wait till outcome of US election for its next step and in that scenario, Dec'16 may be an ideal time.

Back home, after budget 2016 projected a fiscal deficit of 3.5%, market has already discounted 0.50% rate cut by RBI on 5-th Apr'16. So, even if RBI cut by 0.50%, the repo rate will be 6.25% and the RRR will be around 1.25% (Avg CPI 5%), which may be in the lower range of comfort zone for RBI (preferred range of RRR 1.5-2%). In that scenario, market will take that rate cut cycle is over in the near term and will focus again on the fundamentals ( deteriorating corporate earnings and huge NPA of PSBS; i.e. twin balance sheet issues of India) and we may see selling/long unwinding.

Market will also watch forthcoming state elections & BJP's prospect there along with Govt's ability to pass the GST & other important reform bills in the RS. But, going by the present political situation and falling popularity of NAMO, it may looks tough.

Analytical Charts:

No comments:

Post a Comment