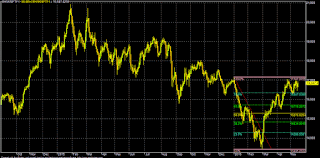

BNF (May): 16795 (LTP)

Either sell around 16960-17060 or 17150-17250 or on rise around 17350-17450;

TGT: 16650-16430-16300*-16195-16040-15890-15715-15500-15250*-15100

(5-15 days)

TSL> 17600

Note: Consecutive closing (3 days) above 17600 zone, BNF may further rally up to 17825-18075* and 18150-18600 zone in the near term (alternative bullish case scenario from the present trading level).

Except new age private banking space (Yes/IIB/Kotak & HDFC Bk) there is not so much ray of hopes on the present NPA mess(specially for the PSBS) and even ICICI & Axis banks are also badly affected.

As par some estimates, the present stressed assets in the Indian banking system may be around Rs.8 lakh cr and by FY-17, it may reach around 11-15 lakh cr (15% of the total loan book may be termed as NPL).

Normally, the present NPA mess may be termed as "Full Banking Crisis", specially for the PSBS and except SBI, which is "too big to fall" and strong balance sheet or support of the Govt, all the other PSBS are literally are on the Govt sponsored "ventilator".

Now apart form Govt sponsored recapitalization, recovery of NPA is vital for the banks. But as par the Q4FY16 trend (usually higher seasonal recovery for financial year ending pressure), for BOB, actual recovery was around Rs.1492 cr against NPL/Watch list of Rs.42000 cr (i.e. around 3.5% in Q4). At the same quarter, there is fresh addition of Rs.4400 cr NPL (cumulative addition 8515 & recovery 4130). Thus at this rate, it will be very difficult for the stressed PSBS to sustain themselves and only other income (treasury/trading/FX/cross sales) may not be sufficient for their survival.

In a country like India, its not possible to close down these PSBS and thus merger among various 27 listed PSBS to less than 10 large PSBS may be the viable alternative for operational synergy. But this merger among various PSBS will take time (at least 3-5 years) among various regulatory hurdles and oppositions of banking unions.

Moreover, initially, this type of merger may put more pressure on the principal bank and may be EPS dilutive (for example, recent merger proposal of SBI may be negative for its bottom line for the first 1-2 years) and the benefit of the same may be felt only after 4-5 years.

As historically, real rate of interest and other regulatory charges are quite high in India, in comparison to other parts of the developed economy, it may be one of the prime reason for today's NPA mess, where cost of doing business is quite high and not viable (under financing from Indian Banks).

Apart from some policy paralysis, project approval delays, tepid global growth and export demand, FX volatility (competitive devaluation), reckless lending & borrowings by banks and some corporates, another reason may be RBI is always "behind the curve" (which may be good for yield hungry bond investors but not good for our real economy).

Analytical Charts:

No comments:

Post a Comment