Trading Idea: Nifty Fut (May)

SGX-NF: 7900 (CMP)

NSE-NF: 7885 (LTP)

Sell either around 7940-7985 or on rise around 8010-8060-8095-8125;

TGT: 7810*-7760-7680*-7635-7570-7530*-7475-7415-7315-7240 (5-15 days/SPOT)

TSL> 8180

Note: Consecutive closing (3 days) above 8180 for any reason, NF may further rally up to 8225*-8325 & 8480-8675* in the near term (alternative bullish case scenario from the present trading level).

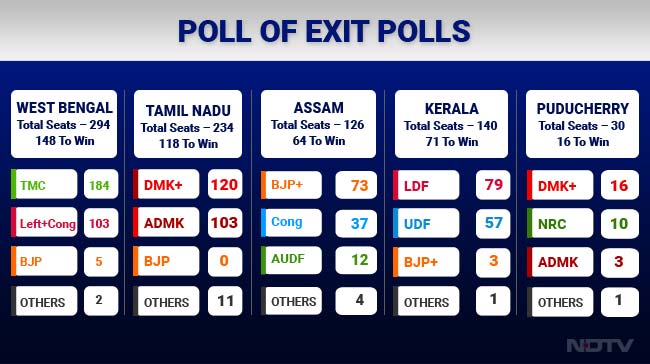

Yesterday's exit poll results of just concluding state elections are showing that on an average BJP+ may get only 81 seats against 285 seats (proportionately) it got in the last Parliament election amid NAMO wave.

Apart from Assam, NDA failed miserably in all the other states and probable victory in Assam was also highly anticipated amid 15 yrs Cong rule of incumbency. In Kerala, historical trend of alternative Govt (UDF/LDF) in every 5 years may be also followed this time.

Ultimately, if the actual results come in as par the average exit polls, this will not help BJP in any way in the required RS numbers and as par various political permutations & combinations, its not possible for BJP either to have majority in RS before 2019 and by that time, we have another Parliament election and most probably, it will be a tough test for NAMO wave unlike in the last election.

So, for passage of GST and other important reform bills, BJP has to depend upon INC & other regional parties to a great extent and keeping in mind the next wave of state elections (UP/Punjab etc) & subsequent political battle, it will be not an easy task for the Govt either.

Apart from this political scenario, actual progress & distribution of monsoon and ongoing Q4 results may be the immediate drivers of our market. Although Q4 results so far are descent apart from the PSBS, market may be looking for an average earnings (EPS) growth of at least 15-20%, whereas average CPI & GDP in India is now around 5% & 7%.

Basically, Indian economy may be transforming from "unaccounted to accounted mode" (black to white money) and this effect may also be reflecting on the consumer demand & corporate earnings.

Apart form that tepid export (due to global slowdown and currency wars), excess capacity, lack of strong consumer demand, severe stress in "twin balance sheets", historical high cost of doing business In India (high interest rates & other regulatory charges/hurdles) may also be some of the reasons for slow down despite higher infra spending and some regulatory reforms by the Govt. Investors are waiting for revival in demand and more cuts in actual bank lending rate to start fresh investment cycle.

Globally, depressed core operating margin, specially for the US corporates, debt crisis (specially for US energy companies and China), QE liquidity fulled excess capacities in commodity space (such as Oil/Steel etc) and consequent banking stress may be some of the headwinds apart from Brexit talk.

The buy back fulled rally in SPF may also be in some type of question and as par some report, smart money (institutions) are net sellers for the consecutive 12 weeks. Sustaining below 2025, SPF may fall 1945 are in the near term and for any rally up to 2115, it has to sustain over 2080 (CMP: 2060).

Analytical Charts:

Courtesy: NDTV IMAGE

No comments:

Post a Comment