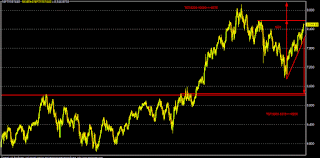

Nifty Fut (July) closed at

8583 at almost day high (8584) after making a low of 8509.55.

Technically, NF now need

to sustain above 8605 for an immediate target of 8675* and

8740-8785 & 8845-8875 area.

On the other side of the

NF trade, sustaining below 8585, NF will fall towards

8490-8460* and 8405*-8315 zone.

Today, global market got

some boost after BOJ reportedly confirmed about issuing some

types of "Perpetual Bonds" as a part of its fresh QQE

initiative. But the same was denied later along with some

concept of "Helicopter Money" (after Indian mkt hours).

Meanwhile, after Indian mkt

hours, BOE stayed neutral and did not cut the the rate as

expected (by 0.25%) and emphasized on the Aug meet for a full

assessment of the UK economy and any rate cut with QQE in the

background of "Brexit" uncertainty. Subsequently, global market

retreated to some extent and it will an interesting US session

today to be watched.

Also, yesterday after taking

office, the new UK PM although emphasized on the "real Brexit"

publicly ("Brexit is Brexit"), privately, May has communicated

"going slow" tactics to Merkel (Germany) and Hollande (France)

as par some reports. Clearly, May will be in no hurry to invoke

Article-50 for the real exit/official negotiations with the EU,

the environment of overall uncertainty may do more harm to the

British economy in the coming months.

Today INC confirmed about

meeting with the Govt/BJP regarding the much expected passage of

GST in the RS, starting from 18-th July. But from the overall

commentary and body language of the INC leader, it appears that

there is still some major differences regarding the core demands

of the INC (GST rate capping at max 18%, redressal mechanism

etc) and passage of GST may not be a "done deal" yet this time

too !!.

Also, despite apparent

confidence of GST passage in the RS this time, BJP seemed to

loosing the same as the Parliament session coming closer and it

may be the real fact that without Cong's active or passive

support, GST passage may be quite tough this time too !!.

The Indian market also got

some booster dose by the IMD comments that the much awaited

monsoon has already covered the entire part of India ahead of

two days.But, going forward, actual quantity & distribution

of monsoon will be more vital to see, if it really helped the

distressed rural economy amid past two years of drought/deficient

rain.

Today, PSBS were extremely

strong amid market talk of Govt announcement of the

recapitalization amount.

Also, as par some reports,

RBI's initiative of "neutral liquidity" recently from the past

policy of "deficient liquidity" has significant positive impact

on the Indian market. It may be a "Desi/Indian" version of QQE

as RBI released almost Rs.80000 cr of liquidity by OMO to the

Indian banking system.

Market is also keenly

watching Govt's official announcement regarding name of the new

RBI Gov. As par some market talk, Govt may announce on or before

16-th July the name of the next RBI Gov ahead of Parliament

session staring on 18-th July.

Tomorrow's Infy result will

also be keenly watched. In the meantime, TCS just announced its

Q1 result and its slightly above market expectations (tomorrow's

price action may be vital for TCS).

Today, India's June WPI came

at 1.62% against estimate of 1.19% (prior 0.79%). The higher

trajectory of inflation may cause RBI to stay at side line in

the Aug meet, but higher manufacturing inflation may also be

termed as positive after years of contraction as it may be indicating

incrementally better demand & pricing powers despite lower

base effect of raw materials (commodities).

No comments:

Post a Comment