Market Wrap: 16/12/2016

(17:30)

What’s For The Next Week ?

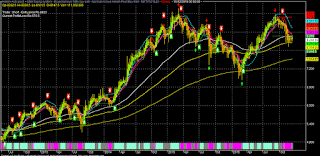

Technically Nifty Fut (Dec @8146) has

to sustain over 8210-8295 area for further rally towards 8345-8395 & 8435-8485

zone in the near term.

On the other side, sustaining below

8125-8040 zone, NF may further fall towards 7980-7900 & 7840-7645 area in

the short term.

Although market participation by FPI(s)

is lacklustre due to year end Christmas holidays as of now, there may be too

many headwinds against too little tailwinds for the market in the coming days

and this may cause significant volatility/meltdown in the new year-2017.

Nifty

Fut (Dec) today closed around 8146 (-0.33%) in an extreme range bound choppy day

with lower volume and made an opening minutes high of 8189 and session low of

8135.

Apart

from the ongoing political & economical chaos because of demonetization,

domestic market may be also under pressure for “hawkish hike” by Fed this week

and consequent meltdown in China market, which corrected by around 5% in this “Fed”

week and moreover by 6.5%from its recent high.

Although,

weak Yuan as a result of “Trumpism” were earlier seen as beneficial to Chinese

economy for export edge, the real fear of outflow concern now creeps in as a

result of “excessive” strong USDCNY, which is hovering now around 6.95, almost

7% strong from the level of 6.50 few months ago.

As

par some reports, the primary reason behind the recent plunge in USTSY bonds

may be because of huge selling by PBOC of its USTSY holdings, which is around

its historical low now.

But,

more & more selling of USTSY bonds by PBOC is also affecting the US bond yields, which in turn also strengthening

the USDCNY and attracting more panic outflow from China.

Today

Chinese bond market was halted for lower circuit and subsequently China market

(A-500) plunged. Chinese authority also clamped down on the overseas M&A

activity, which they think as another way of USD outflow in disguise.

As

USD outflow from China accelerates, PBOC is being forced to sell its USTSY bond

holdings for USD inflow, which in turn also devaluing the Yuan, causing more

panic outflow. It seems that PBOC/China is now in a serious problem of outflow,

which is taking a spiral cycle and PBOC may be running out of options.

Also

a strong USDCNY is causing significant spikes for Chinese imports, which may be

also affecting its economy and cost competitiveness of the export in turn.

Apart

from the strong USDCNY & outflow concern, China has its own problem of huge

NPA/NPL (stressed banking assets), shadow-banking and recent regulatory action on

some specific institutional investors.

Thus,

in the above scenario, any China jitters will not only cause significant

meltdown for the Chinese market, but it may also affects adversely the global financial

market & India also (“risk off” trade due to Chinese jitters as in last

year after Dec’15 Fed hike).

Technically, sustaining above 6.97-7.00

zone, USDCNY may further rally towards 7.15-7.25 in the near term.

Similarly, for China-A-500 index (LTP:

10065), sustaining below 10140-10000 zone, it may fall more towards 9900-9200

area in the coming days; i.e. China market may correct further by 8-10% &

USDCNY may further rally by another 4-5% in the short term.

The

primary reason behind plummeting of 10YUSTSY bonds & surging of US bond yields

may be selling by PBOC and “Trumponomics” & “Trumpflation” may be the

secondary reasons as it’s just an election rhetoric as of now and not a

reality.

But,

Trump’s post election victory speech may also act as an catalyst for the surge

in US bond yields & USD (“We will rebuild America again”) and actual “Trumponomics”

may take considerable time & modification in the coming months (corporate &

personal tax cuts, actual size of fiscal spending, ease of doing business in

US, enhanced import duties on US imports to encourage “Made in US” theme etc).

As

par some reports, BOJ may be also thinking to tighten or hike its rate in 2017

in order to steepen the JGY bond yields and to have equilibrium with the JPYUSD

interest rate differential (hawkish Fed). In 2017, Japan is also expected to

come out of its decade old deflation spiral as a result of devalued Yen (costly

import) and higher oil prices, apart from some higher wage inflation.

Thus,

in the coming days, China jitters may be a real threat for the “risk on” trade

including Indian market along with an unusual “Hawkish” Fed, probable BOJ tightening,

EU & US political & credit risks and various other geo-political

events.

If

there will be another China meltdown like last year, then it’s also almost

certain that Fed will not hike thrice as par its 2017 dot plots and may hike

only once in Dec’17 similar to the fate of its own 2016 dot plots projections,

which has 4 hikes, but ultimately ended in 1 hike (Dec’16) after China jitters

& Brexit.

Although,

in that scenario, no Fed hike in June’17 may be positive for “risk assets” in

H2CY17, but it’s very interesting to see, how central banker’s QQE is effective

against geopolitical & nationalistic events in the coming years (Real

Brexit, US political risks for Trumpism, Trumponomics & other EU political

risks).

For

Indian markets, apart from the above global headwinds, demonetization led

economic & political disruptions, delay in GST implementation eventually

after 2019 general election (?), partial destruction of Indian consumption

(30-40%?) as a result of “wealth destruction & redistribution” following

Govt’s stance of “war on black money” may be some the domestic jitters.

No

doubt, Investors has huge “faith” in NAMO as a credible political leader, who

can leads from the front unlike some of his predecessors and thus it was not

BJP, but NAMO who “won” the 2014 general election for his mass appeal as a “leader”,

who can “fight” the menace of poverty, corruption, black money and can also

contribute for development & employment (Gujrat model).

But,

the current economical & political chaos because of the “demonetization”

led “political gamble” for the sake of “war against black money” theme may be

now changing towards different narrative for “digital cash less economy” theme

and another “VDS”.

NAMO

may have taken this “political gamble” ahead of series of state elections and

also 2019 general election to hide the real issue of huge un/under employment

in India. As par various reports, almost 12 lakh of fresh job aspirants are

entering the Indian job market every month as of now and the economy may be

producing only around 4-5 lakh new jobs much less than the overall numbers of

job seekers. The present demonetization is creating more unemployment for not

only in the grass root levels, but also at higher levels of the economy.

Thus,

this “political gamble” may be turned into a “political blunder” for NAMO in

the coming months and that may be a real risk for 2019 general election,

despite the fact that there is no “acceptable” national leader to the stature

of NAMO as of now. In such scenario, regional leaders & politics may take

the centre stage and investors (FII) may also lose faith in India.

Apart

from the impending India political risk, market may also look into the

forthcoming Q3FY17 results, GDP and other macros & high frequency economic

data in order to assess the real collateral damage done to the economy for the

surprised demonetization.

Against

all the above headwinds, some Indian tailwinds may be there in the form of a “dream

budget” for FY-18, direct & indirect tax cuts, RBI repo rate cuts of

0.25-0.50% (?), lower CPI and some stimulus out of expected “windfall gains”

because of demonetization (some windfall gain in direct taxes) to reduce the “pain”

of “Aam Admi”, which is so far deprived of any “visible gain”.

But,

still then, overall impact of the “headwinds” may be far greater than the “tailwinds”

and eventually, Indian corporate earnings recovery cycle may not only be

delayed, but may also be degraded.

Valuation

wise, at an expected Nifty EPS of around 405 (?) in FY-17 & average PE

multiple of 18 may translate a fair value of 7290 for Nifty in 2017.

SGX-NF

CHINA-A-500

USDCNY

No comments:

Post a Comment