Market Mantra: 15/12/2016

(08:30)

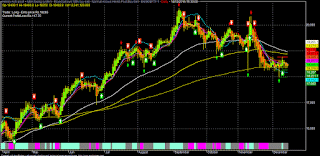

Watch 8195-8250 & 8090-8040 Zone In

Nifty Fut (Dec), Which May Open Around 8115 Today

Combination of stronger USD and

domestic jitters of economic slowdown and political disruptions as a result of

demonetization may be significant headwinds for the Indian market in the coming

months despite relatively better macros among its EM peers.

As

par early SGX indication, Nifty Fut (Dec) may open around 8115 (-89 points)

following weak global cues after Fed sounds more optimistic (hawkish) than

market expectation after hiking 0.25% (as highly expected).

Overall

tone of Yellen was not so dovish as usual after a hike and quite unexpectedly

Fed projected 3 dot plots (hikes) in 2017 instead of 2 hikes expected earlier.

Moreover, Yellen’s comments about the 0.25% rate hike as “very modest

adjustment” and her “confidence” in the US economy has sent the USD & US

bond yields soaring and for the first time after a decade, market may be taking

Fed seriously. As a result, FFR is now showing a probability of another June’17

hike around 70% from 50% yesterday and almost 100% for two hikes in H2CY2017.

Contrary

to the earlier market expectation, Yellen seemed to be unfazed by the potential

negative impact of higher US bond yields & USD on the US & global

economy and confident about strength of US economy to withstand at least 0.75%

of another rate hike in 2017 and also supported the Fed’s dot plots of 3 hikes

in 2017. Consequently, US stock market also fall as yield spread between 10YTSY

& 2YT bond flattens.

As

Fed will be on the rate tightening (normalization) path in the coming years by

hiking 0.50-0.75% in each year through 2017-19, other G-10 central bankers may

also be forced to follow or refrained from any additional easing in order to

keep the interest rate differential at an optimum level and era of “easy money”

policy may be over with theme of more fiscal spending.

Now,

depending upon the actual plan of Trump for the expected fiscal spending and

implementation, Fed may either hike twice or thrice in 2017.

For

Indian market, a strong USD and less “easy money” may be some of the headwinds

along with pain of demonetization, political risks & lack of reform

implementation (GST/Land & Labour reform).

Technically, NF need to sustain above

8090 zone today; otherwise it may further fall towards 8040*-7980 & 7900*-7860

area for the day (bear case scenario).

On the other side, for any strength, NF

need to stay above 8135 area for some rebound towards 8195*-8250 &

8310-8375* zone for the day (bullish case scenario).

Similarly, BNF (LTP: 18403) has to

sustain above 18200-18150* area today; otherwise it may further fall towards

17900-17850* & 17650*-17300 zone for the day (bear case scenario).

On the other side, for any strength,

BNF need to stay above 18500-18550* area for further rebound towards 18650*-18800

& 18900*-19100 zone for the day (bullish case scenario).

SGX-NF

BNF

No comments:

Post a Comment