For BNF consecutive closing above 14200, expect 14800-15500;

Otherwise, it will be weak and sustain below 13800,

May again fall towards 13500-13300 in the days ahead

Banking sectors reform proposals in the budget may be the driver of BNF;

But most of these proposals are already known to the market !!

In the current scenario of " Twin Balance Sheet" challenges

(PSBS & some corporates),

Who will fund the "India growth story" ?

Trading Levels: BNF-Mar

LTP: 13853

| BNF-Mar | LTP | 13853 | ||||||

| SL=+/- | 25 POINTS | FROM | SLR | |||||

| For | Intraday Swing | Trader | ||||||

| T1 | T2 | T3 | T4 | T5 | SLR | |||

| Strong > | 14200 | 14270-355* | 14460-560 | 14620-780* | 14830-880 | 15035-251 | <14150 | |

| Weak < | 14150 | 14115-050* | 13980-925 | 13840-795* | 13725-650 | 13540-500 | >14200 | |

| FOR | Conservative | Positional | Trader | |||||

| T1 | T2 | T3 | T4 | T5 | SLR | |||

| Strong > | 14200 | 14355* | 14560 | 14780* | 14880 | 15251-515 | <14150 | |

| Weak < | 14150 | 14050* | 13925 | 13795* | 13650 | 13500-315 | >14200 |

We all know as par "Indradhanush" blue print, announced last year, Govt will infuse Rs.70000 cr by 2019 in the PSBS, while the PSBS are supposed to raise around Rs.1.10 lakh cr from the market.

But as par some reports, courtesy RBI's AQR effort, PSBS stressed assets may reach around Rs.8 lakh cr by Q4FY16 and further towards Rs.15 lakh cr by FY-17 from the present (Q3FY16) level of Rs.4 lakh cr.

Thus PSBS may require at least Rs.3 lakh cr in the near term just to stay afloat and BASEL-III requirements. So, Govt's "Indradhanush" project may be too late & too little and considering the deterioration of balance sheets of PSBS and the on going market turmoil (gloom & doom sentiment), it will be not easy for most of the PSBS to raise funds (except SBI for its bigger size) and under the circumstances, Govt may announce to sell some "non-core PSUS" & some SUTTI stakes to raise funds for the recapitalization effort of the PSBS.

But even for divestment and to get a fair price, market need to be stable condition at a much more higher level than we are seeing now. Clearly, Govt need to sell those stakes in a "Bull market" years ago and not in the current "Bear Market" scenario.

At present, due to various fiscal constraints and limitations like commitments in 7-PC/OROP, incremental allocations for infra spending (capex) and unpaid food, fertilizer and oil (FFO) subsidies for previous years, Govt is not in a position to infuse huge capital at one go to the PSBS.

As our Govt follow "cash" instead of "accrual" accounting systems, it did not accounted the FFO subsidies, but it may be a liability in the Govt Balance Sheet. As par some analysis, if we take this unpaid FFO subsidy and nominal GDP, the fiscal deficit figure (3.7% of GDP) may be much higher and if one consider the states fiscal deficit, then the consolidated figure may be well above 8%. So, this so called fiscal deficit of 3.5-3.7-3.9% of GDP may be nothing but an accounting tricks.

Moreover, the GDP growth rate of 7.5% is also misleading as the other high frequency economic data like electricity consumption, railway/road freights, capacity utilization of manufacturing sector, vehicle sales (2-W & 4-W), corporate earnings growth, liquor/bear sales etc are pointing towards incremental slow down of the real Indian economy. As par some analysis, India's actual GDP growth rate under the old system may be around 5-5.5%

India's real rate of interest (RRI) may be the highest among the comparable countries. If we consider CPI (AVG 5.5%) and borrowing costs for the corporates/SMES (AVG 12.5%), the difference is 7%, which may be termed as the true RRI for the borrowing class (except housing loan) to do business in India with bank funding.

Naturally, this high borrowing costs which prevailed in India for decades is not sustainable for business, specially in a tepid consumption demand environment for the last few years.

Also, there are some past so called "policy paralysis/stalled projects" and along with this, ongoing transformation from the "black money" to the "white money" economy may be largely responsible for the tepid earnings of the corporates and resultant NPA fiasco of the PSBS today.

Also India is now a high cost economy due to various reasons, like high regulatory charges, high indirect taxes and non-transmission of lower oil prices to the consumers/overall economy.

The India Govt may be too much greedy and find an easy way to tax oil products and various cess/surcharges rather than trying to expand the income tax base, which is very low at around 10% of GDP now (standard 20-30%) and number of people actually paying any income taxes is too low.

So, unless & until the basic structural issues of our economy are properly resolved, India may be continue to be a "ray of hope" in the global economy, rather than a "real bright spot" despite its so called appeal of 4-D (demand/democracy/demography/de-regulation).

In tomorrow's budget, there may be some higher personal income tax deduction on the housing loan interest (from Rs.2 to 3 lakh), which may be positive in the short term for some PSBS (SBI) and private banks engaged in greater retail housing loans (HDFC/Kotak/Axis/ICICI/LICHSG). But, again, this is also a known factor and may be already priced in to a great extent and when corporate balance sheet is in huge stress, then its may be a matter of time, retail loans will also be in some kind of stress and so called "bright" private banks may also be affected (like Kotak/HDFC/Indusind etc).

Apart form the budgetary proposal for the Banks, depending on the Govt capex/Borrowings, FRBM road map etc, RBI may again surprise the market with a mid-policy rate cut (0.25%) just after the budget or on the occasion for a "Holi Gift" to the nation (like last time). But again there will be question of proper transmission by the banks to the borrowers/economy and market/BNF will again be sold.

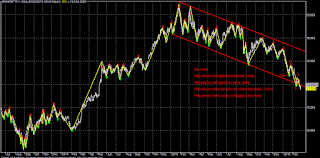

Technically, BNF may be in the 4-th Wave (corrective) in the daily EW cycle and the extended targets of the same may be around 13500-12650. In the alternative scenario, if BNF closed consecutively (3 days) above 14150-14200 zone, then the impulsive 5-th Wave can take us towards 14800-15500 area.

Analytical Charts:

No comments:

Post a Comment