Market Mantra:

16/11/2016 (08:15)

As

Par early SGX indication, Nifty Fut (Nov) may open around 8220 (+94 points) as

US bond yields halted and Trump trades began to fade.

Oil

is also supporting the “risk on” sentiment after it rallied significantly on

the back of renewed optimism about production cut/freeze in the forthcoming

OPEC meet aided by Saudi & Russia jawboning. But going ahead, Trump’s

election rhetoric of an America independent on its own oil reserve and policy of

more US oil pumping, thereby reducing oil import to a great extent (oil trade

barriers) may hurt the sentiment.

Indian

market sentiment today may be supported by the better/mixed macros (CPI &

Trade Balance).

Yesterday,

after market hours, CPI came at 4.20%, which is in line with estimates (prior:

4.31%). Trade balance reports indicate tepid trend of exports, although imports

surged on the back of Gold.

After

last few days “blood bath”, market may cover some shorts on the hopes of RBI

rate cut in Dec’16 amid lower CPI figure. If average CPI stands around 4.5%,

then RBI may set repo rate to 5.75-6% (4.5+1.25/1.5) theoretically; thus may

cut 0.25-0.50% by Dec’16-Feb’17. But, in reality, RBI may watch the high

probable Fed rate hike of 0.25% in Dec’16 and to maintain interest rate

differential and INR stable against USD, RBI may wait until Feb’17 for more

inflation data and actual Fed action. Also, RBI may also consider the present

issues of cash flow, its short term effect on inflation and overall economic

activity as a result of Demonetization.

Domestic

market may watch the Political battle as the winter session of Parliament will

commence today and progress of GST (final legislation) as a result of Govt’s “War”

on black/unaccounted money. In the long run, Govt may need to lower the legacy

of high tax regime in India to wipe out the basic cause of “unaccounted money”

earned through legitimate way by the “common people” (like sale of lands/real

estate etc).

Also

the continuing battle (war of words) between Tata & Mistry may hurt the

sentiment of Tata cos as well as the overall market sentiment as issue of

Indian corporate governance is involved here.

Technically,

after opening gap up today, NF need to sustain above 8190-8175* area for

further bounce back towards 8265-8295* & 8365*-8395 and 8425-8485* zone for

the day (bullish case scenario).

On

the other side, sustaining below 8175 area, NF may further fall towards

8140-8105* & 8065-8045* and 7975-7925* zone for the day (under bear case

scenario after positive opening).

Similarly,

BNF (LTP: 19370), need to sustain above 19600-19650* area after opening gap up

for further rally towards 19850-19950* & 20050-20200* & 20350-20450*

zone for the day (bullish case scenario).

On

the other side, sustaining below 20550-20500* area, BNF may further fall

towards 19400-19300* & 19150*-19040 and 19000-18850* zone for the day

(under bear case scenario).

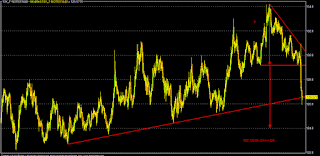

SGX-NF

BNF

US10YTSY

No comments:

Post a Comment