Updated: 08:55

SGX-NF: 10765 (+23; +0.21%)

Expected BNF opening: 25960 (+0.25%)

SPX-500: 2669 (-0.50; -0.02%)

Note: Gap-up opening on mixed global cues as Trump will announce his decision of the Iran nuke deal coupled with some fall in Indian 10Y bond yields after RBI intervention (OMO) on Monday and a better prospect of BJP in the Karnataka election. Although a combination of higher USD and higher oil is bad for the import-oriented Indian economy, the higher USD may be good for the Nifty earnings as almost 60% are export-heavy. Better than expected earnings from ICICI Bank may also help.

Fut-I (Key Technical Levels)

Support for NF:

10720/10660-10635*/10590-10540/10490

Resistance to NF:

10800*/10840-10875/10935-10975/11050

Support for BNF:

25825/25650-25400/25250-24950/24700

Resistance to BNF:

25925/26050-26150/26275-26550/26750

Support for SPX-500:

2660/2635-2610/2595-2580/2565

Resistance to SPX-500:

2675/2695-2705/2730-2750/2770

Technical View (Positional-Nifty, Bank Nifty, SPX-500):

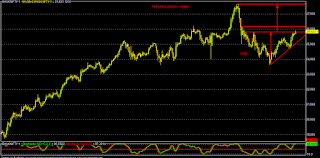

Technically, Nifty Fut-I (NF) has to sustain over 10800 for a further rally towards 10840/10875-10935/10975 in the short term (under bullish case scenario).

On the flip side, sustaining below 10780 NF may fall towards 10720/10660-10635/10590 in the short term (under bear case scenario).

Technically, Bank Nifty-Fut (BNF) has to sustain over 25925 for a further rally towards 26050/26150-26275/26550 in the near term (under bullish case scenario).

On the flip side, sustaining below 25875-25825, BNF may fall towards 25650/25400-25250/24950 in the near term (under bear case scenario).

Technically, SPX-500 now has to sustain over 2695-2705 for a further rally towards 2730/2750-2765/2785 in the near term (under bullish case scenario).

On the flip side, sustaining below 2685-2675, SPX-500 may fall towards 2660/2635-2610/2595 and 2580/2565 in the near term (under bear case scenario).

Valuation metrics:

Nifty-50: 10715; Q3FY18 EPS: 403; Q3FY18 PE: 26.59; Avg FWD PE: 20; Proj FY-18 EPS: 418; Proj Fair Value: 8360

Bank Nifty: 25852; Q3FY18 EPS: 807; Q3FY18 PE: 32.03; Avg FWD PE: 20; Proj FY-18 EPS: 961; Proj Fair Value: 19220

SPX-500: 2672; TTM Q4-2017 EPS: 111; TTM PE: 24.07

Market Wrap: 04/05/2018

NSE-NF (May):10742 (+83; +0.78%) (10747-10645)

FOLLOW ME: TWITTER.COM/ASISIIFL

SGX-NF

BNF

SPX-500

WTI

Thanks for this post; it’s very useful for investors

ReplyDeleteIndia Breaking News Today