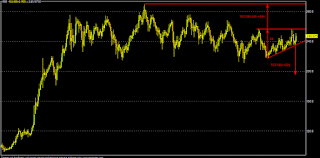

Technical Charts:

Technical Analysis:

Technical Trading Levels (Positional):

Stock Analysis & Some Useful Inputs:

Techno Funda Valuation As Par BG Metrics (Modified):

Current Median Valuation: 300

Projected Fair Valuation: 330-350-385 (FY:16-18)

Technical Analysis:

IRB (CMP: 249) has immediate support of around 242-238 & 233-226 zone. Sustain below 226, it may further fall to 220-210 area and consecutive closing below that, it could crash to 205-197-184 & 160 territory in the worst bear case scenario.

On the upside, sustaining above 242, immediate target may be 256 and consecutive closing above that 270-276 might be the target in short term, In the mid term term, only sustaining above 276, IRB may scale up to 290-300-315 area and consecutive closing above that 370 might be the target in the long term under bull case scenario (FY:16-18).

Technical Trading Levels (Positional):

| SL</>2 | FROM SLR | |||||||||

| IRB | CMP | 249 | ||||||||

| T1 | T2 | T3 | T4 | T5 | T6 | T7 | SLR | |||

| Strong > | 238 | 242* | 256-262* | 270 | 276 | 290 | 300 | 315 | <233 | |

| Weak < | 233 | 226 | 220 | 210* | 205 | 197 | 184 | 160 | >238 | |

Stock Analysis & Some Useful Inputs:

Yesterday IRB gave a technical break out (>242) amid some positive news flow that one of its subsidiary has raised debt of Rs.1400 cr to execute a mega road project awarded by NHAI (total cost of the project is around Rs.2290 cr as of now). The concession period for the project is 27 years.

Q4FY15 consolidated result/EPS of IRB was also above street estimates and looking ahead, Govt's massive push for infrastructure, mega road projects (@10000 km in the current FY), "Smart City" theme may revive this sector by H2FY16 (as widely expected).

Road, being the vital infra life line in "Modinomics & Shinning India", we may see actual progress of work in various stalled projects and also significant FDI in this sector in the coming days. Presently, our respected road minister (who is dedicated his life to mega high way projects) has assured the PMO to construct high ways @17-18 km/day and projected target is above 20 km/day by FY:16-17.

Certainly, under this circumstances, IRB may be one of the beneficiary of the expected push for mega road projects along with some other competitors like L&T.

But, there are some serious risks in IRB, as CBI is investigating its Chairman in a 2012 case of murder of a RTI activist (who had exposed irregularities involving forged documents in a township project by IRB). This is as par old report & need to be verified further about the status of the case as of now.

Techno Funda Valuation As Par BG Metrics (Modified):

Current Median Valuation: 300

Projected Fair Valuation: 330-350-385 (FY:16-18)

| SCRIP | EPS(TTM) | BV(Act) | P/E(AVG) | LONG TERM | SHORT TERM | MEDIAN VALUE | 200-DEMA | 10-DEMA |

| IRB | 15.45 | 117.31 | 24.6 | 298.54 | 302.84 | 300.69 | 234.5 | 241.3 |

| IRB | 18.62 | 129.05 | 24.6 | 327.74 | 332.46 | 330.10 | 234.5 | 241.3 |

| IRB | 20.74 | 142.15 | 24.6 | 345.89 | 350.87 | 348.38 | 234.5 | 241.3 |

| IRB | 25.1 | 156.55 | 24.6 | 380.52 | 386.00 | 383.26 | 234.5 | 241.3 |

No comments:

Post a Comment