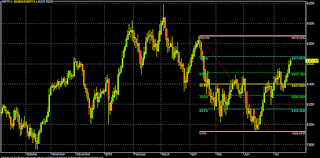

Time & Price action suggests that NF (LTP:8631 & SGX 8643) has to sustain above 8680-8700 zone for an immediate target of 8760 and consecutive closing above that it may scale 8805-8875 and 8900-8950-9000-9050-9075 territory. Only sustaining above 9075, NF may scale 9191 area in the near term under bullish market scenario (GST Bill passed/decent Q1 result as par expectations/dovish RBI & Fed/Satisfactory monsoon & RBI rate cut in Oct'15 etc).

Technically, on the downside, inability to sustain over 8700 zone may result in selling and below 8680-8665, it could fall to 8618-8600-8560 area. Consecutive closing below 8560, NF may further fall to 8534-8513-8490 zone & sustaining below that we will be again in the territory of 8460-8420 & 8400-8360-8335-8290 zone. Below 8290, we could further fall to 8240-8204-8180-8136-8089-8000 territory in the near term in bear case scenario ( GST Bill not passed/very poor Q1 result/hawkish RBI & Fed).

Bottom Line: Technical Trading Levels (Positional)

| Gap Up/Dw | (Indicative) | |||||||

| SGX NIFTY | 8642 | 11 | ||||||

| NF-JULY | LTP | 8631 | ||||||

| SL (+/-) 10 POINTS | FROM SLR | |||||||

| Intraday Swing | Trader | |||||||

| T1 | T2 | T3 | T4 | T5 | SLR | |||

| Strong > | 8620 | 8665-80* | 8700-60* | 8805-75 | 8900-50 | 9000-75 | <8600 | |

| Weak < | 8600 | 8560-34* | 8513-490* | 8460-400 | 8360-35 | 8290-40 | >8620 | |

| FOR | Conservative | Positional | Trader | |||||

| T1 | T2 | T3 | T4 | T5 | SLR | |||

| Strong > | 8620 | 8680* | 8760* | 8875 | 8950 | 9075-9191 | <8600 | |

| Weak < | 8600 | 8534* | 8490* | 8400 | 8335 | 8240-8180 | >8620 | |

As par reports, GST bill may be passed in the forthcoming monsoon session of upper & lower houses starting from tomorrow as there is now not so much decent among various political parties including UPA. But land bill may be again sent to cold storage due to vehement united oppositions and there are also some concerns among NDA's own MP(s) and members. Basically, land is a sensitive issue and various political powers has significant amount of investment in lands & real estates either officially or unofficially. So, the present form of land bill proposed by the Govt may hurt their own interest also. Govt may not take an extreme step like convening joint session of parliament to pass the land bill risking its vote bank in forthcoming assembly elections, specially in Bihar. For the Govt, majority in RS is much more important in longer term than passing of the land bill right now. So, the Govt may take a compromise strategy with the opposition and will pass only GST Bill this time.

The passage of GST bill alone will be an significant reform in the eye of the investors as it may contribute around 1.5% in the GDP as par some calculations. Regarding land bill, Govt may choose to left it in the state subject and each state may be asked to formulate its individual land acquisitions policy keeping in mind the reality of the situation and in their best interest. Parliamentary procedure/President may approve each state's land reform bill/policy amendments individually. Thus, there will be intense competition among various states to design its land policy and attract investments & creation of jobs.

Regarding China, although the Govt there is making an all out effort to stabilize the stock market there after recent routs of around 30% from its peak, which was followed by 140% rise for the last one year, FII(s) may be looking for an safe heaven & stable EM stock market such as India (a sweet spot in BRICS also), considering China's recent crack down on "short sellers" !! Main land China stock market may take some more time to mature & stabilize and FII(s) might be permitted to participate more gradually in a phased manner after some years. Also quality of most of the Chinese companies are not so great unlike India. Russia & Brazil is also a very volatile market. Thus FII(s) poured around $1 billion in India for the first two weeks of July alone. Also, DII(s) has now considerable muscle unlike 2007-08 and it will be not a one sided story for India, given the Govt will always be supportive to the market for its own interest (disinvestment theme).

But ongoing Greece drama may pose some threat and today their Banks will reopen after nearly two weeks of shut down. It may be an interesting scenario today as also their VAT rate is to be hiked as par bail out package.

The Greece bail out might be already discounted by the market to a large extent as also our GST passage possibility. So it might be happened as "Buy the rumour & sell the news" type of scenario in our market, given the political ramp up in the Parliament for the next few days, until the GST bill passed in the RS actually.

So, technically, unless & until we sustain over 8700-8760 from here, NF may be again drifted to 8500-8200 zone in stead of 9000-9200 area.

No comments:

Post a Comment