Market Wrap: 15/06/2017

(17:00)

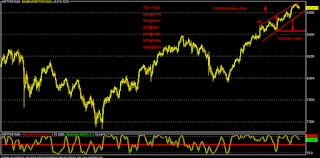

NSE-NF (June): 9599

(-39; -0.40%) (TTM PE: 24.25; Near 2 SD of 25; TTM EPS: 395; NS-9578)

NSE-BNF (June): 23394

(-92; -0.39%) (TTM PE: 29.42; Near 3 SD of 30; TTM EPS: 795; BNS-23392)

For 16/06/2017:

Key support for NF: 9580-9530/9505

Key resistance for NF:

9635-9675

Key support for BNF:

23200-23000

Key resistance for

BNF: 23500-23650

Time & Price action suggests that,

NF has to sustain over 9675 area for further rally towards 9715-9770 &

9825-9865 in the short term (under bullish case scenario).

On flip side, sustaining below 9655-9635

area, NF may fall towards 9580-9530/9505 & 9470-9405 area in the short term

(under bear case scenario).

Similarly, BNF has to sustain over

23650 area for further rally towards 23750-23875 & 24000-24100 area in the

near term (under bullish case scenario).

On the flip side, sustaining below

23600-23500 area, BNF may fall towards 23200-23000 & 22900-22700 area in

the near term (under bear case scenario).

Nifty

Fut (June) today closed around 9599, almost 39 points down after making an

opening session high of 9626 and late day low of 9584. Indian market today

opened gap down by around 15 points following tepid global cues after report of probe by US special

Counsel Muller on Trump for the alleged Russian link, soft US economic data

(core CPI/Retail sales) released yesterday, a hawkish hike by Fed indicating

another hike in Dec’17 with gradual tapering of its B/S (QE bonds).

Although, overall

statement of Fed was dovish as expected, it’s also maintained the previous

guidance of another hike in 2017 (Dec); in addition to this, Yellen sounded

somewhat hawkish in the Q&A session and termed the tepid US CPI as transitory.

In brief, Fed may be optimistic about US growth, job market but quite

pessimistic about inflation & also on the fiscal stimulus (Trumponomics). But,

Yellen is not ready to acknowledge the subdued inflation and this Fed fantasy

may be keeping the market in balance; as par Fed, consecutive rate hike is a

sign of confidence on the US economy.

Having said that,

although Fed looks very optimistic on US economy, market may not believe Fed

fully, considering its past record of poor credibility and that’s why we may

see range bound movement of USD, despite Yellen sounded surprisingly hawkish in

its presser yesterday; divergence of US soft & hard data may also keep the

market quite cautious about prospect of US economy.

Overall, for the US

economy, real wage growth may be very tepid and this lack of wage inflation may

be also affecting the US consumer spending or rather discretionary spending; a

central bank monetary policy alone may not be sufficient to rectify it; some

structural resolution is necessary (like job skill, proper education,

automation issues etc).

But, more than Fed

hike; taper tantrum may hurt the risk trade & specially EM assets. All eyes

may be now on the PBOC/China for its monetary policy adjustments after Fed hike

as historically it may be the primary source of concern after Fed hike; but

PBOC has already tightened its monetary policy and Yuan is now relatively

strong. So, even if PBOC do not tighten now, USDCNY, which is now around 6.75,

may not break the 6.90-6.95 barrier.

But, as a result of a

hawkish Fed, which is not only talking about multiple rate hikes, but also

implementing it despite soft US economic data and also in the process of

normalization of its B/S, other major central bankers may be now forced to be

neutral or even hike by following Fed in order to keep the policy rate

differential at present level. Thus, the era of easy money may be over for the

time being, which is also not good for the risk/EM assets.

Back to home, RBI (India) may be constrained to be neutral in order

to keep the policy parity with a hawkish Fed despite room for rate cut. All

eyes may be now on the GST (disruptions) and PSBS consolidation & NPA

resolution; Indian market may continue to digest the impact of GST on the

Q1& Q2FY18 because of de-stocking both at manufacturing &

dealers/retailers level for concern of input tax credit issues and changes in

taxes.

Apart from GST concern, domestic market sentiment may be also

affected by reports of acute cash shortage in different states as ATMS are

running dry; SBI has reported almost 51% currency shortage in its ATMS. As cash

withdrawal restrictions by the Banks are not in place now, informal economy may

be again limping back, raising question of the overall DeMo exercise.

There was also some apprehensions about the efficacy of the

Govt’s move to consolidate different smaller PSBS with some selected larger

ones on region basis as this may not solve the core issues of NPA and

recapitalization. On the other side, bigger PSBS having relatively strong B/S

as of now may also be affected due to this merger/consolidation move. Already core EBITDA margin of big PSBS are in

question now and the proposed consolidation may make the core operating margin

weaker.

Private banks were under some pressure today after report that

ICAI has written to the RBI, questioning the auditor’s role in the NPA

divergence issue with the RBI report.

Today Nifty was helped by RIL (report of retail fuel outlets

under Jio banner with BP), Auro Pharma (USFDA approval and optimistic

management guidance about US business) and other Pharma scrips for USFDA

approval of certain drug molecules.

Nifty was dragged by BPCL, ONGC, Gail (concerns of GST on oil

products and daily price revision system; Govt’s move to consolidate or merge

different Oil & Gas companies into 2-3 large entity; RIL’s plan of fuel

retailing similar to telecom disruptions). Also, IT (TCS/INFY), PSBS (BOB/SBI),

Private Banks (HDFC/ICICI/INDUSIND/AXIS/YES Bank) dragged the index. Metal

counters were looking strong initially after reports of price surge of China

steels due to planned production cut; but later they were also succumbed to

general market weakness.

Elsewhere, in UK, BOE was in neutral mode as expected amid soft

UK economic data & political concerns. But market was surprised by votes of

3 hawks in MPC for a rate hike; subsequently GBPUSD jumped but later again

nosedived due to reality of UK political situation, Brexit uncertainty; it also

seems from the overall language of BOE that they are quite confused amid higher

inflation & weaker currency coupled with lower growth.

Meanwhile,

GBPUSD again come into pressure as market may be realizing that despite some

surprised hawks in MPC, Carney may not in mood to hike rates amid intensified

UK political jitters; Theresa’s own leadership may be now in question.

Also,

market was looking for some more BOE policy clarity in today’s evening Mansion

House event, where Hammond & Carney were supposed to deliver some speech

regarding UK monetary policy; but due to recent London fire incident, the event

is cancelled for the time being. So GBP bulls might be disappointed, although

BOE may publish the official speech of Carney later on. It was this Mansion

House, where Carney first indicated about UK rate hikes in 2014; market may be

looking for something similar now.

USDJPY

is now trading around 110.30, jumped by almost 0.71% and approaching the key

resistance zone of 110.60 after Yellen sounded quite hawkish contrary to

earlier market expectations of a dovish stance. The rally is being further

supported by Fed’s stance of gradual tapering of its QE bond (B/S) and upbeat

US economic data just published.

Today’s US economic data came as:

NY

Empire manufacturing index: 19.8 vs 4.0 expected (PRIOR:-1.00)

June

Philly Fed index: 27.6 vs 24.0 expected (PRIOR: 38.8)

Initial

jobless claims: 237K vs 242K estimate (PRIOR: 245K)

IIP

(May): 0.0% vs +0.2% expected (PRIOR: 1.1%)

Thus,

except IIP, all the other US economic data today is quite upbeat; but tepid IIP

data may be also negative for the USD and market may again raised concern about

true underlying US economic strength to withstand multiple Fed rate hikes.

In any way, USDJPY now need to stay

above 110.60-111.75 for further rally; tomorrow’s BOJ meet may be

vital now. BOJ is expected to be neutral as of now; but any indication of QQE

bond tapering to counter Fed’s gradual tapering may also risk the USDJPY rally.

Technically, GBPUSD (1.2704) now need to sustain above

1.27952-1.28205 for any further rally; otherwise it may fall towards

1.25290-1.23640 in the coming days.

SGX-NF

BNF

USDJPY

GBPUSD

Article Courtesy: frontiza.com

For Advisory SUPPORT:

https://t.me/MarketLive_free

No comments:

Post a Comment