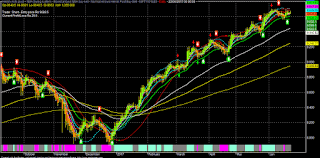

Market Mantra: 21/06/2017

(08:30)

SGX-NF: 9670 (+12

points)

For the Day:

Key support for NF: 9635/9605-9580

Key resistance for NF:

9725-9775

Key support for BNF:

23600-23450

Key resistance for

BNF: 23875-24000

Time & Price

action suggests that, NF has to sustain over 9725 area for further rally

towards 9775-9825 & 9865-9950/10050 in the short term (under bullish case

scenario).

On flip side,

sustaining below 9705-9695 area, NF may fall towards 9635/9605-9580 &

9530/9505-9470 area in the short term (under bear case scenario).

Similarly, BNF has to

sustain over 23875 area for further rally towards 24000-24115 & 24250-24435

area in the near term (under bullish case scenario).

On the flip side,

sustaining below 23825-23750 area, BNF may fall towards 23600-23450 &

23300-23100 area in the near term (under bear case scenario).

As

par early SGX indication, Nifty Fut (June) may open around 9670, almost 12

points up following mixed global cues. Overnight US market/DJ-30 closed in

negative (-0.27%) amid selling in energy related scrips (slump in oil) and

subdued Caterpillar earnings/guidance. Oil was under severe pressure despite

mixed EIA inventories and a panic OPEC squabbling about further production

cuts; although Iran oil minister was advocating for a further production cut,

some of the other OPEC nations may not agree with that citing Iran’s own high

level of oil production. Also, ongoing supply glut and credit tightening may be

the primary structural issues for which oil may dip further below $42-40 area,

reminding the horror scenario of post Fed hike in Dec’15.

China

is trading in upbeat mode following its inclusion in MSCI EM index; but China’s

gain may be India’s pain also. Indian market may see some fund outflow.

Indian

market may focus on yesterday’s RBI minutes, which may be termed as quite

hawkish and RBI/MPC may not be in a mood to cut in Aug’17. All the eyes may be

now on NPA resolution & IBC act effectiveness apart from GST implementation

& high probable short term disruption. Also, SEBI war on P-Notes may be in

focus.

SGX-NF

No comments:

Post a Comment