Market Wrap: 06/11/2017 (17:00)

NSE-NF (Nov):10479 (-8; -0.07%)

(TTM PE: 26.53; Abv 2-SD of 25; TTM Q1FY18 EPS: 394;

NS: 10452; Avg PE: 20; Proj FY-18 EPS: 418; Proj Fair Value: 8360)

NSE-BNF (Nov):25587 (-81; -0.32%)

(TTM PE: 28.35; Abv 2-SD of 25; TTM Q1FY18 EPS: 902;

BNS: 25571; Avg PE: 20; Proj FY-18 EPS: 961; Proj Fair Value: 19220)

For 07/11/2017:

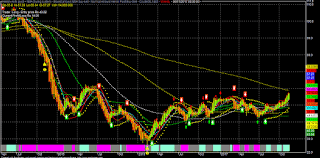

Key support for NF: 10445-10390

Key resistance for NF: 10525-10575

Key support for BNF: 25390-25150

Key resistance for BNF:

25800-25950

Trading Idea (Positional):

Technically, NF has to sustain over 10525 area for further rally towards

10575-10625 & 10675-10835 zone in the short term (under bullish case

scenario).

On the flip side, sustaining below 10505 area, NF may fall towards 10445-10390

& 10290-10195 zone in the short term (under bear case scenario).

Technically, BNF has to

sustain over 25800 area for further rally towards 25950-26100 & 26325-26615

zone in the near term (under bullish case scenario).

On the flip side,

sustaining below 25750 area, BNF may fall towards 25390-25150 & 25050-24850

area in the near term (under bear case scenario).

Indian market (Nifty Fut/India-50)

today closed around 10479, almost unchanged (-0.07%) after making an opening

session low of 10441 and late day high of 10530, making another fresh life time

high of around 10490 in Nifty Spot.

Indian market today opened around 10453, gap down by almost 36

points on muted global/Asian cues amid renewed concern about China’s “Minsky

Moment”, games of Saudi Thrones and Trump’s rhetoric about “huge trade imbalance”

with China & Japan.

But Indian market recovered quite

smartly soon after opening tracking, tracking similar recovery in

China & HK market on a Moody’s report that non-core shadow banking

activities in China is on a declining trend; it was

affected earlier by panic of China’s “Minsky Moment” and tougher regulation.

PBOC Gov yesterday penned a lengthy article about “hidden, complex, sudden,

contagious & hazardous” threats to the Chinese economy from excessive

leveraging and signalled that deleveraging move is unlikely to ease up now.

But China market gained

support later today when Moody’s report shows

that shadow banking virtually came to a halt in H12017 after relentless

crackdown by the Govt and total shadow banking assets actually declined in

terms of GDP for the 1st time since 2012.

Thus China closed almost

0.49% higher from deep loses and the entire regional market including HK &

India also changed the bearish tone.

But, still China’s shadow banking activities is around 83% as on

June’17 vs a peak of 86% in 2016; it has fallen because of non-issuance of

higher risk instruments such as Bank’s wealth management (WM) products and

certain asset management plans by NBFC.

But core shadow banking activity

remains including entrusted loans and undiscounted banker’s acceptance

(unsecured & unreported loans), which is continously growing till now and

PBOC is basically fighting against it.

Indian market was also boosted by upbeat earnings from some

fragile PSBS (like Indian Bank today), but concern of a higher oil may have

also affected the overall market sentiment today; latest saga of Saudi Thrones

& political turmoil is boosting oil (WTI) right now, which is poised to hit

around $60 soon; PMO has convened a meeting on 10th Nov to take

stock of the alarming macroeconomic situation out of oil.

A higher oil is not good for Indian economy and the market,

although it may be good for certain oil & gas cos like ONGC, which rallied

by almost 4%, while OMCs lost today.

But, Indian market today succumbed to selling pressure in the

last half an hour of trade amid Moody’s

warning about rating downgrade for RIL on excessive capex, debt and poor

visibility of EBITDA improvement for R-Jio; risks of growing digital service segment

& muted ROC/ROE coupled with debt funded capex & organic acquisitions

may cause rating downgrade.

On the positive side, Moody’s today revised outlook for three

PSBS (BOI/OBC/UNB) on Govt’s plans for RECAPS; Moody’s also revises outlook for

Tata Steel to stable from –ve on TSE JV & domestic optimism.

As par Moody’s, RIL may face cash flow pressure in the next

12-18 months over scheduled payments to the creditors and net borrowing may be

at elevated levels till 2019; today RIL closed almost 1.35% down.

Private Banks were in pressure today after reports suggest that Yes Bank is

on a cost (employee) cutting measures and slashed notice period to 30 days, but

PSBS are on the limelight on earnings, recaps & NPA resolution optimism;

Yes Bank closed almost 1.93% lower.

A SC observation for the JPA case regarding JP Infratech that

holding co can’t be liable for group cos financial irregularity may have also

affected the overall banking sentiment today, because it may also affect the whole

IBC/NCLT settlement/recovery process.

Overall, Indian market was today helped by Automobiles, consumer

durables, FMCG, techs, Media, metals, PSBS, property developers, while dragged

by private banks, pharma & NBFC to some extent.

Europe May Edged Down On Subdued Global Cues Amid Renewed Concern About China's "Minsky Moment" & Saudi Political Turmoil

Asia Closed Almost Flat On Muted Global Cues But Recovered On Hopes Of China Shadow Banking Reduction

USD Edged Down On Concern Of Higher Oil & Geo-Political Risk Aversion Amid "Games Of Saudi Thrones"

SGX-NF

WTI

WTI

No comments:

Post a Comment